Can I Sell My Home if I Have a VA Loan? (Assumable Mortgages Explained)

Here's the short answer: Yes, you absolutely can sell your home with a VA loan, anytime you need to. The VA doesn't restrict when or how you sell your home.

I've helped dozens of military families navigate selling a home with a VA loan here in San Antonio. I'm going to walk you through everything you need to know, including how your assumable mortgage could be your secret weapon in today's market.

I'm Anthony Sharp, a U.S. Air Force veteran and San Antonio Realtor who specializes in military relocations. I've been where you are, facing PCS orders, wondering about my VA entitlement, and trying to figure out the smartest path forward. Let me share what I've learned from both sides of the transaction.

Ready to sell your San Antonio home? Get your free home valuation and personalized selling plan from a realtor who understands military life at sharprealtygrouptx.com.

Understanding Your Options When Selling a Home with a VA Loan

When you financed your home with a VA loan, you secured one of the best mortgage products available. Zero down payment, no PMI, and competitive rates made homeownership accessible.

Now that it's time to sell, you have two primary paths forward. The right choice depends on your timeline, equity position, and market conditions.

Option 1: Traditional Sale and Payoff

This is the most straightforward approach. You list your home, accept an offer from any qualified buyer, and use the sale proceeds to pay off your existing VA loan at closing.

Once the loan is fully repaid, your VA entitlement is restored. You're free to use it again on your next purchase immediately.

In San Antonio's current market, this strategy works well. According to the latest San Antonio Board of REALTORS data from October 2025, the average home price sits at $377,040, representing a 2% year-over-year increase.

If you've built equity, a traditional sale lets you capture that value immediately. Most military families choose this route because it's clean and straightforward.

Option 2: Loan Assumption Strategy

Here's where things get interesting. Your VA loan is assumable, meaning a qualified buyer can take over your existing mortgage, including your interest rate and remaining balance.

In today's environment where rates have fluctuated, if you locked in a low rate, your loan becomes a powerful selling advantage. Buyers recognize the long-term savings compared to obtaining a new loan at higher rates.

I recently worked with a veteran who had a 3.25% VA loan on a home valued at $350,000 with a $280,000 remaining balance. By marketing the assumable loan, we attracted multiple offers and sold above asking price.

The assumable feature of selling a home with a VA loan can differentiate your property in a competitive market. It's a benefit many sellers overlook.

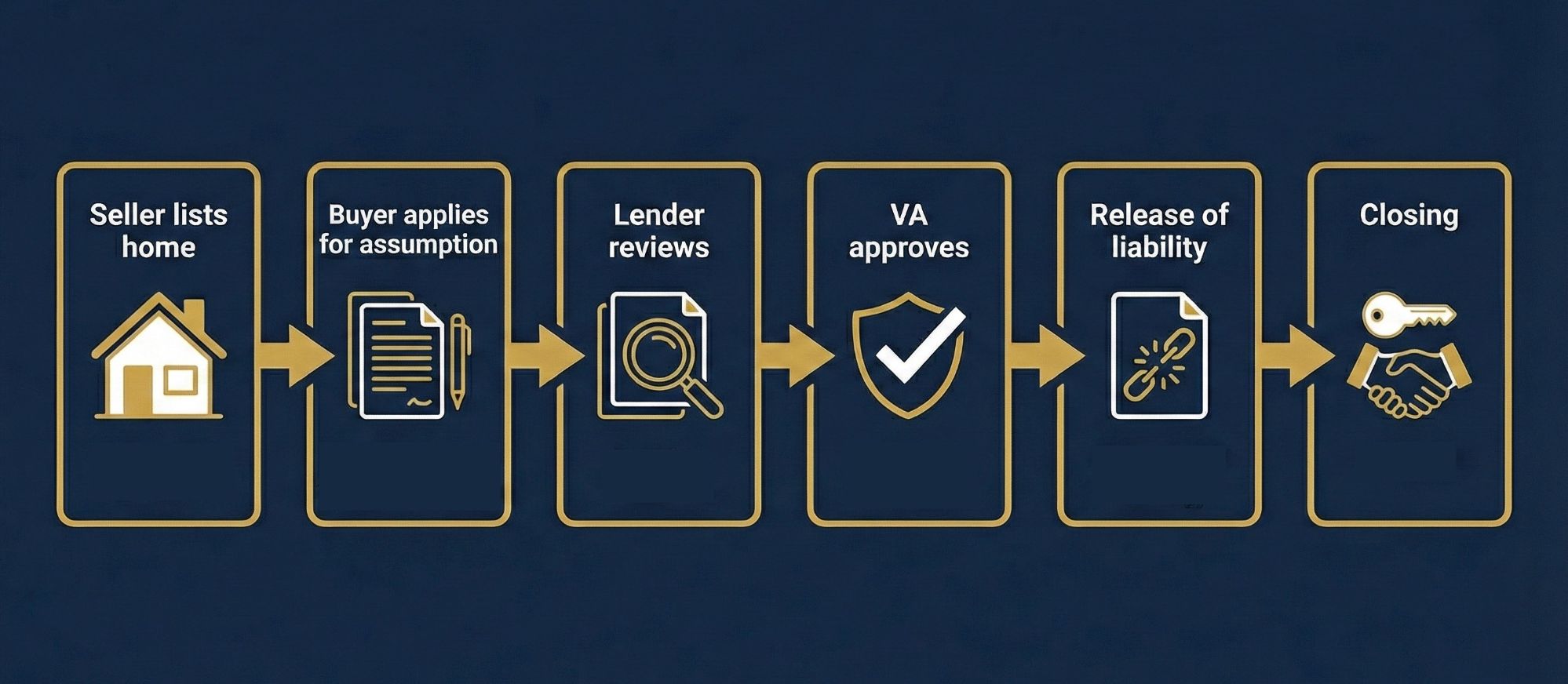

The VA Loan Assumption Process: What Sellers Need to Know

Offering your home with an assumable VA loan requires understanding three critical components. Buyer qualification, entitlement implications, and liability release all play important roles.

Buyer Qualification

The new buyer doesn't have to be military, but they must meet VA creditworthiness standards and income requirements. The lender and VA must both approve the assumption.

The buyer will also need sufficient cash to cover your equity. That's the difference between your home's value and the loan balance. This can be substantial if you've owned the home for several years.

Your VA Entitlement

This is crucial to understand. If a non-veteran assumes your loan, your VA entitlement remains tied to that property until the loan is fully repaid.

This could limit your ability to use VA benefits on your next purchase. You may only have partial entitlement available depending on your county's loan limits.

However, if a VA-eligible buyer assumes the loan, they can substitute their entitlement for yours. This frees you to buy again immediately with your full VA benefit restored.

Release of Liability

Without proper documentation, you could remain liable if the buyer defaults. This is a serious risk that many sellers don't fully appreciate.

Always secure a formal release of liability through the VA and your lender as part of the assumption process. I work closely with title companies and attorneys to ensure this paperwork is bulletproof for my clients.

The release of liability is non-negotiable. It protects you from future financial responsibility for a home you no longer own.

Navigating a PCS and need to sell fast? Visit sharprealtygrouptx.com to see our PCS Game Plan and learn how I handle the details while you focus on your move.

Real-World Benefits of Marketing Your Assumable VA Loan

In October 2025, San Antonio saw 2,639 home sales, a competitive but manageable market. Standing out matters, and an assumable VA loan provides that edge.

When you advertise your assumable VA loan with an attractive rate, you create differentiation that conventional listings lack. This marketing strategy attracts serious buyers quickly.

Lower Buyer Costs

Assumptions typically involve lower fees and fewer closing costs than new mortgages. The VA funding fee for assumptions is just 0.5% of the loan balance, compared to higher fees for new VA purchases.

This cost savings makes your property more accessible to buyers. They can save thousands of dollars compared to obtaining a new loan.

Faster Closings

With an assumption, much of the loan infrastructure already exists. There's no new loan origination, potentially shortening the timeline from offer to closing.

For military families on tight PCS timelines, this speed advantage is valuable. Every week matters when you're coordinating a cross-country move.

Broader Buyer Pool

By accepting assumptions, you open your home to VA buyers, civilian buyers who qualify, and even investors. I maintain a database of VA-approved buyers specifically looking for assumable properties.

This expanded pool increases competition for your home. More competition typically means better offers and terms.

Common Seller Concerns About Selling a Home with a VA Loan

Over my years helping military families, I've heard every worry about selling a home with a VA loan. Let me tackle the big ones directly.

"Will selling with a VA loan take longer?"

Not necessarily. With proper preparation and an experienced military realtor, VA sales close smoothly.

The key is working with professionals who understand VA appraisal requirements. We guide you through any property condition issues before listing so there are no surprises.

"What if the appraisal comes in low?"

VA appraisals protect buyers by ensuring they don't overpay. If an appraisal comes in below contract price, you have options.

You can adjust the price, negotiate with the buyer, or find a buyer who can cover the gap. In balanced markets like we're seeing in San Antonio, appraisals typically align with sale prices when properties are priced correctly from the start.

"What about closing costs?"

VA guidelines allow sellers to contribute up to 4% of the sale price in concessions if they choose. However, this is negotiable.

Strong offers from qualified VA buyers often include reasonable terms that don't burden sellers unfairly. It's about finding the right buyer, not accepting unreasonable demands.

San Antonio-Specific Market Considerations

Our local market dynamics matter when selling a home with a VA loan. With median prices at $310,000 and inventory providing more buyer negotiating room, sellers benefit from strategic positioning.

Military-connected buyers make up a significant portion of our market given Joint Base San Antonio's presence. Understanding this demographic is key to successful marketing.

I've closed 110 properties worth $75 million in San Antonio and surrounding areas, with an average listing price of $350,000. What I've learned is that transparency about your VA loan status creates trust.

Strategic pricing combined with professional marketing creates successful outcomes regardless of market conditions. The San Antonio market remains healthy with stable pricing despite slower sales velocity.

Your Next Steps: Preparing to Sell

Whether you choose a traditional sale or leverage your assumable loan, preparation is everything. Taking the right steps upfront prevents delays and complications later.

Step 1: Contact Your Loan Servicer

Confirm your current balance, interest rate, and whether your loan is assumable. Most VA loans are assumable, but it's best to verify.

Ask about the assumption process and any specific requirements your lender has. Get this information in writing.

Step 2: Request a Preliminary Title Report

Identify any liens or issues that could delay closing. Address these problems early while you have time to resolve them.

Clean title is essential for a smooth transaction. Don't wait until you're under contract to discover title issues.

Step 3: Consult with a Military-Experienced Realtor

Work with someone who understands VA processes and can position your home competitively. Experience with military relocations makes a significant difference.

We know how to market assumable loans effectively. We understand PCS timelines and the unique challenges military families face.

Step 4: Gather Documentation

Collect records of any improvements you've made that add value. Upgraded HVAC, new roof, kitchen remodels, all impact your home's worth.

Documentation helps justify your asking price and reassures buyers. It demonstrates you've maintained the property well.

Step 5: Understand Your Entitlement Status

Know how the sale will impact your ability to buy again. If you're planning to purchase another home with a VA loan, this timing matters.

I help clients navigate these scenarios regularly. There are strategies to maximize your benefits even in complex situations.

Maximizing Your Sale: Strategic Positioning

The key to successfully selling a home with a VA loan is positioning. You need to highlight advantages while addressing potential buyer concerns proactively.

Your assumable loan is an asset, not a liability. Market it prominently in listings and showings.

Price your home competitively based on current San Antonio market conditions. Overpricing extends your time on market and ultimately costs you money.

Professional photography, drone tours, and comprehensive marketing reach qualified buyers quickly. First impressions matter tremendously in real estate.

Consider timing your listing for peak military PCS season. Spring and summer see increased activity as families relocate before the new school year.

Frequently Asked Questions

Can I sell my home with a VA loan before paying it off?

Yes, you can sell anytime regardless of how much you owe. You simply pay off the remaining balance at closing from your sale proceeds.

Will I lose my VA loan benefits if I sell?

No, once your loan is fully paid off through the sale, your entitlement is restored. You can use your VA benefits again immediately.

Do I have to sell to a military buyer?

No, anyone who qualifies can buy your home. VA loans don't restrict who can purchase your property, whether through traditional sale or assumption.

How long does a VA assumption take?

Typically 45 to 60 days, though this varies by lender. It's comparable to a traditional closing timeline with proper preparation.

What happens if the buyer defaults after assuming my loan?

If you obtained a proper release of liability, you're protected. Without it, you could remain financially responsible, which is why this documentation is critical.

Can I sell my home with negative equity?

This requires a short sale, which has different requirements and VA approval. It's more complex but possible with the right guidance and lender cooperation.

Your Service, Your Advantage

I've walked this path myself, and I've guided countless service members through selling a home with a VA loan. The bottom line is this: your VA loan is not a limitation, it's an asset.

Used strategically, it can help you sell faster and for more money than comparable listings. The San Antonio market remains healthy, creating opportunity for prepared sellers.

Your service earned you the VA loan benefit. Now let's use it to your maximum advantage in your home sale.

Categories

Recent Posts