Military selling house can be one of the most stressful parts of a PCS move. As a U.S. Air Force veteran and San Antonio relocation expert, I've helped countless military families navigate this process successfully.

I understand the pressure of getting orders and needing to sell quickly. That's why I've developed a plan that works for service members facing tight timelines.

In San Antonio, average days on market range from 69–74 days depending on the neighborhood, compared to roughly 27 days nationally. That local pace gives you a bit more runway to prepare your listing, but with PCS timelines, time is still precious.

In this guide, I'll share straightforward, actionable tips on military selling house – from market data and selling strategies to VA loan tips and tax breaks. Everything here is based on my experience as a veteran and REALTOR in the Alamo City.

Military home seller guide

San Antonio Market Trends for Military Sellers

Our local market is moderately competitive. The median home price in San Antonio is around $260K (as of fall 2025), with most homes selling near list price.

In the latest reports, the average sale price was ~$382K and median $310K, reflecting steady demand. Days on market and price per square foot ($154 locally) vary significantly by neighborhood – homes near military bases often move faster than the city average.

San Antonio's strong military population is a major advantage. Joint Base San Antonio, Lackland AFB, Randolph AFB, and Fort Sam Houston create a constant pool of buyers moving here.

Work with an agent who knows JBSA communities. Proximity to bases, schools, and amenities can be major selling points for fellow service members.

Understanding the Local Timeline

Market data helps set expectations: nationally, homes sell much faster, but in Bexar County we typically see a more measured pace. Timing varies greatly by neighborhood – areas near bases and in high-demand school districts often sell 20-30 days faster than the city average.

Use this extra time to prep your home smartly. At the same time, know that rising inventory means buyers have more choices. So pricing and presentation are critical to stand out.

In a market like ours, a well-priced home in the right neighborhood tends to attract quick interest – especially properties near military installations that often sell well below the city average for days on market.

Prepping Your Home: Military Seller Tips

Getting your house in shipshape is key. Here's what I tell all military sellers:

Enhance Curb Appeal and Declutter

First impressions count. Mow the lawn, trim shrubs, and add a few potted plants.

Inside, declutter so buyers can envision their own things in the space. Simple fixes like a fresh coat of paint (neutral colors) and minor repairs go a long way.

Remove Personal Military Items (OPSEC!)

Under operational security rules, don't broadcast your PCS on your yard sign or photos. Put away unit decals, flags, uniforms, awards, weapons on display, or any identifiable ID.

It's safer to store these until after the sale. Also, avoid photos or tour descriptions that mention bases or deployments.

This keeps your move discreet and your family safe.

Meet VA Requirements

If buyers will be using VA loans, ensure the house meets the VA's Minimum Property Requirements (MPRs). These are basic health-and-safety standards (working plumbing, safe electrical, HVAC, etc.).

If in doubt, get a VA-savvy inspector before listing to catch and fix any VA issues. Repairing these upfront prevents delays or contract removals when a VA appraisal happens.

Market Your VA Loan Benefits

One tip I give sellers: advertise that your home is VA-eligible. Many buyers don't realize VA loans are assumable.

If your current VA loan has a low interest rate, the buyer (if they qualify) could take over that rate. For example, assuming a 3% VA loan when rates are 7% could be a huge selling point.

Make sure buyers and their agents know the loan balance and rate. Also, ensure you'll get a lender's release of liability when you sell.

This benefit can differentiate your listing and attract more offers.

Price It Right

Work with your agent (or use tools like the Home Value Estimator) to set a competitive price based on local comps. Don't overprice expecting you can just negotiate – overpriced homes tend to sit.

San Antonio homes often sell at ~91–92% of list price. A sharp price that reflects the pace of moving buyers (many looking August–September each year) can bring multiple offers.

Stage and Photograph Well

If you can, spend a little on professional photos and maybe virtual staging. Highlight special features that military families like (e.g. extra storage for gear, proximity to schools).

We in San Antonio also market summer-ready features: turf lawns, ample shade, etc. Good photos accelerate interest, which is crucial when time is tight.

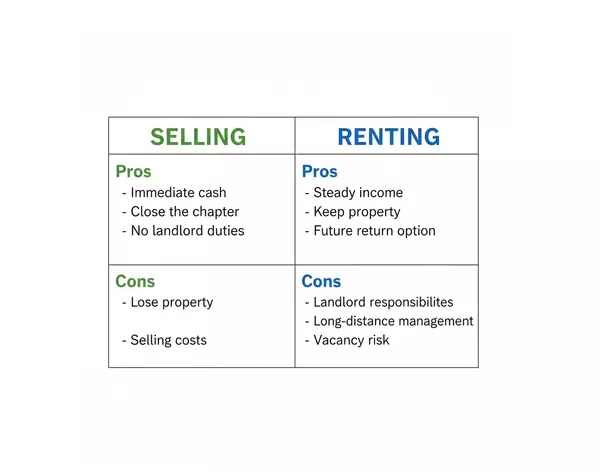

Selling vs. Renting When You PCS

If selling isn't practical right away, you might wonder about renting out the home. Here are some quick points:

Benefits of Selling

Selling gives you cash-out flexibility (a lump sum for your next purchase or PCS costs). You close this chapter before moving and don't have to worry about long-distance property management.

Considerations for Renting

Renting could generate steady income, but it comes with landlord duties (maintenance, vacancies, tenants, taxes). It also ties you to owning a property long-distance.

If you do rent, hire a property manager and consult a tax advisor. You'll have rental income tax rules and possibly can deduct depreciation.

But you also handle mortgage and insurance as a landlord. The right choice depends on your finances and orders.

If you do choose to rent, remember any VA occupancy requirement changes.

Options When Military Selling Your House

When facing a PCS, evaluate how quickly you need to sell and how much effort you want to put in. Here are your main options:

Hire an Agent (Recommended)

In my experience, working with a professional – especially one experienced with military relocations – gets you the best outcome. About 90% of sellers hire an agent because agents handle pricing, marketing, and negotiations.

An agent familiar with DoD moves speaks the same language and can streamline the process. Look for an NAR Military Relocation Professional certification.

An experienced agent can also advise on timing. For example, listing during spring PCS season can maximize your buyer pool.

For Sale By Owner (FSBO)

Going it alone to avoid commission is tempting, but only about 6% of sellers go FSBO – and almost never military sellers. You'll handle marketing, showings, contracts, and negotiations yourself.

Keep in mind that selling under a tight PCS timeline is complex. FSBOs typically take longer and often net less money.

If you try FSBO, at least work with a real estate attorney or title company and be prepared for extra work. In most cases, I advise clients that investing in an agent is worth it for the faster sale and higher price.

Military Relocation Assistance Programs

Don't forget there are specialized military programs to help sell your home. The Department of Defense's National Relocation Program (NRP), formerly known as DNRP, offers tools for DoD personnel.

For example, eligible service members can use a Guaranteed Appraised Value Offer (GAVO) or Buyer Value Option (BVO). GAVO guarantees a minimum sale price: if your home doesn't sell within a set time, the military will buy it at that price.

BVO lets you lock in a sale price from a buyer before the appraisal is done, giving extra protection. There's also home marketing assistance with staging and listing tips.

These programs aren't automatic – you must qualify and apply. Check with your legal office or relocation assistance office for eligibility.

Additional Support Options

Each route has trade-offs. In general, interviewing a qualified agent is the first step.

They can also handle connecting you to cash-buyer programs or VA loan servicing. If you meet the criteria, Navy Federal and some banks offer bridging loans to cover moves between homes.

Also ask about your Dislocation Allowance (DLA) or Temporary Lodging Expense (TLE). These military move allowances can help cover gaps while selling.

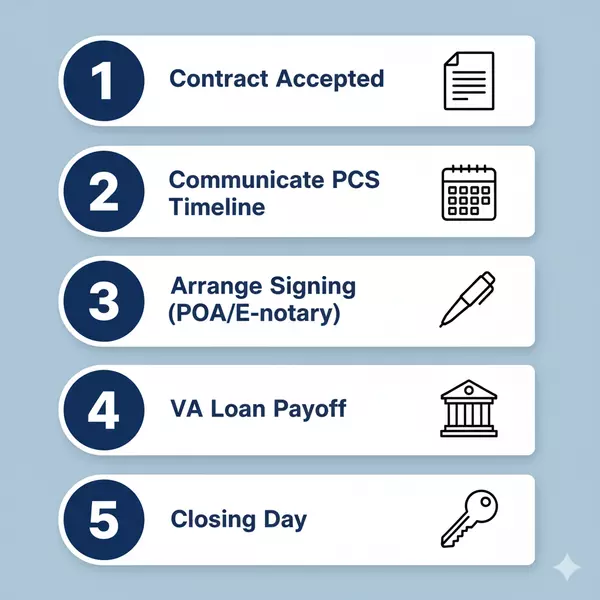

Navigating the Sale & Closing

Once your home is under contract, coordination is key. Communicate your PCS timeline with the buyer's agent early.

If you're still out-of-state, consider a power of attorney for signing documents. Or ask the closing company if you can sign by mobile notary or e-notary.

I've often arranged closings on base or via video for deploying sellers.

VA Loan Payoff Details

Watch for any VA loan payoff specifics. VA loans can have specific payoff procedures.

Some states have prepayment penalties on VA loans, so check with your lender. Ideally, time your closing close to your move-out date.

If you have to leave before closing, ensure utilities stay on. Coordinate keys/trainor with the buyers or agent.

Tax Benefits for Military Sellers

Finally, capitalize on the tax benefits. As a military member, you generally won't pay capital gains tax on your primary home sale up to $250K gain ($500K married).

And importantly, the IRS lets you "pause" your 5-year ownership/use test during a deployment or PCS. For example, if you've owned your house for 18 months and then PCS, the clock stops.

When you eventually sell, your non-resident time in between doesn't count against you (up to 10 years). In short, plan ahead but know the rules are on your side.

I always advise consulting a tax pro familiar with military moves on these details.

FAQ

Does the military help you sell your house?

Yes. The DoD offers programs through the National Relocation Program. If you qualify, you can use the Guaranteed Appraised Value Offer (GAVO) or Buyer Value Option (BVO) to secure a sale price. GAVO lets you set a guaranteed sale price (if it doesn't sell by a deadline, the military buys it at that price), while BVO locks in an offer before appraisal.

Additionally, talk to your Housing Office about relocation allowances. You often get a dislocation allowance (DLA) and can be reimbursed for certain selling/moving expenses under travel regulations. There's also home-selling guidance and sometimes limited funding depending on your branch and situation.