Amazon Shutdown's Impact on San Antonio Real Estate

Amazon made headlines with a recent AWS shutdown, but the real story about Amazon Shutdown's Impact on San Antonio Real Estate is one of growth, not decline. I'm Anthony Sharp, a USAF veteran and San Antonio Realtor®, and I've witnessed firsthand how Amazon's expansion is quietly transforming our local market.

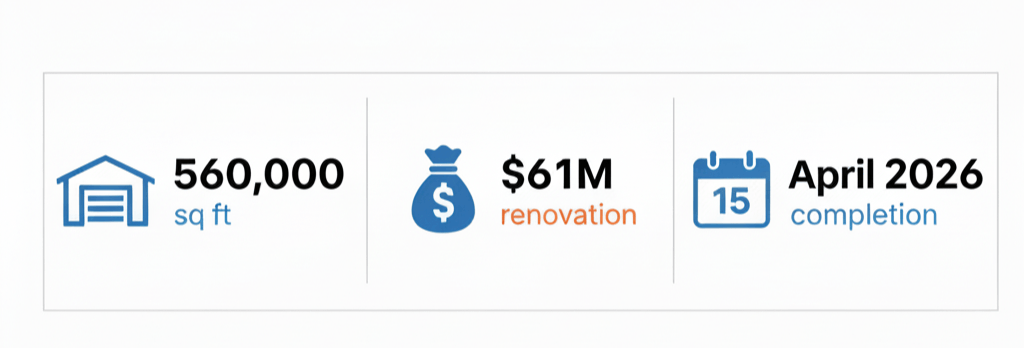

Amazon just acquired a 560,000 sq.ft. warehouse on the East Side with plans for a $61M renovation. This isn't about shutdown concerns – it's about new jobs and housing demand.

Their new facility in Rosillo Creek will handle groceries, liquor, and even house a drone center. That translates to short-term construction jobs and long-term logistics positions. The buzz in my office confirms what the data shows: Amazon's East Side investments signal both immediate and future housing demand.

Contact me for a personalized neighborhood analysis.

Start Your Personalized Consultation

🚨 Amazon Expansion and San Antonio Real Estate: What You Need to Know

In this video, I break down how Amazon’s recent expansion on the East Side of San Antonio is impacting housing demand, job growth, and long-term property values. Find out what this means for homebuyers and investors in the region.

Watch the Full Video Guide →Amazon's East Side Expansion

- Big Purchase, Bigger Plans: Amazon acquired a 560,000-square-foot warehouse at 810 Rosillo Creek Blvd (valued ~$38M). The company is spending $61 million renovating it, with completion set for April 2026.

- New Distribution Hub: The renovated site will store and ship groceries, liquor, and more. It'll also serve as a customer pickup/drop-off point. This isn't a routine expansion – it's a new logistics center with fresh capabilities.

- Drone & Delivery Center: Amazon's nearby fulfillment campus (3 miles away on Cal Turner Drive) is gearing up for drone deliveries. The new warehouse will even house some drone operations.

These facts about Amazon's warehouse in San Antonio mean big things for real estate. When a company of this size plants roots, it signals neighborhood uplift.

Roads, utilities, and retail typically follow. More jobs directly equals increased housing demand in San Antonio. I always tell clients: when institutional employers expand, it drives real estate investment.

East Side Industrial Boom

San Antonio's East Side has become a central industrial corridor. A recent Express-News report highlights a new 310,000 sq.ft. speculative distribution center on Kiefer Road, right by I-10 and 410.

That site lists neighbors like Amazon, H-E-B, and Dollar General – clear signs this area is becoming a major logistics job market hub.

This industrial boom has pros and cons for homebuyers. On the plus side, logistics hubs improve infrastructure. New roads, utilities, even schools and shopping centers tend to pop up around these zones.

Families often move to buffer neighborhoods within a 5–10 minute drive of industrial jobs, boosting home values. But oversupply is a risk.

In Q3 2024, the industrial vacancy rate on the East Side was already 12.3%, with 4.6 million sq.ft. under construction. Too many warehouses could briefly stall job growth.

Still, the key takeaway remains clear: more jobs from companies like Amazon plus infrastructure upgrades equals East Side housing market growth. Shorter commutes and stable military bases already make SA attractive.

Add high-paying logistics jobs and you've got solid momentum. In fact, Amazon's own data shows its investments support nearly 5 million U.S. jobs. Counties with Amazon hubs even see household incomes rise (median up ~$1,350).

That's the kind of economic engine that pulls San Antonio real estate growth forward.

Housing Demand and Home Values

Let's put this in everyday terms: more jobs usually means more people looking to live nearby. San Antonio's population is surging – we added about 24,000 residents in 2023-24.

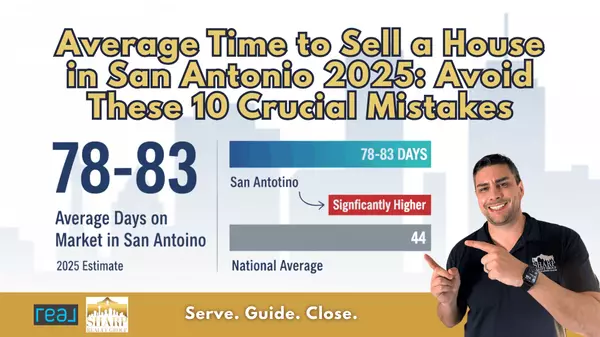

Combined with Amazon's expansion, that spells higher housing demand. Early indicators show stable prices: October 2024 had 2,895 homes sold (+19% YOY) and the median price held around $309,000.

This strength comes from demand especially in the $200k–$500k range.

If you're buying now, flatter prices are actually a gift. My experience shows that buyer leverage is real right now – more inventory means negotiating power.

One recent military family I helped found a home well below list after it sat for a while. For sellers, the message is realistic pricing.

Well-priced homes near job centers (like near JBSA or these new warehouses) still move within months. Overpricing in a cooling market can leave a home stale.

This dynamic, in a military-heavy market like ours, creates great opportunities. The combination of defense jobs (JBSA) and private sector anchors (like Amazon) creates a diverse economy.

It's why SA is known as "Military City USA". In practice, this means Amazon's impact on San Antonio property values is generally positive – even a modest bump in jobs can raise the floor on resale prices.

Smart Homebuying Strategies

If you're ready to tap into these San Antonio real estate opportunities, consider these tips:

- Proximity with a Buffer: Target homes within 5–10 minutes of major corridors (Rosillo Creek, I-10, Loop 410) to shorten commutes, but avoid being right next to heavy truck routes. A small buffer preserves quiet and resale value. Think of suburbs like Schertz/Cibolo, Selma, Universal City, or Converse.

- Track Infrastructure Upgrades: Keep an eye on new roads, utilities, and retail developments popping up near East Side warehouses. These improvements (like a future school or shopping center) often herald neighborhood growth.

- Price Under Median in Growth Zones: The East/Northeast side still has homes under metro median prices. Buying early in these "transition" neighborhoods can lock in gains before prices catch up.

- Long-Term Focus: Plan for a 5+ year horizon. Don't expect instant flips; it can take time for the full impact of job growth to reach housing prices.

In short, look for real estate near Amazon warehouses but on the quiet side of them. Good street connections to I-10 or Rosillo Creek are a bonus.

Always work with someone who knows the local market micro-trends (like me!) so you can buy ahead of the curve.

Risks and Realities

No strategy is risk-free. Here are a few caveats:

- Overbuilding: As noted, SA's East Side is adding millions of sq.ft. of industrial space. If too many warehouses flood the market, hiring may slow. This could temporarily soften housing demand in the very short term.

- Truck Traffic and Noise: Buying next to a warehouse or major distribution street can mean constant noise and diesel traffic. It's better to be a few blocks away. Location quality matters for resale.

- Timing: Infrastructure and perception often lag construction. It may be 2–3 years before a new bridge or store shows up. Don't count on an overnight price surge. Think 5–10 years for the full payoff.

To stay safe, I recommend monitoring sold vs. list trends and ensuring your budget isn't stretched by possible tax/inflation shifts.

In this slowly-cooling market, a 10-year view is usually wiser than trying to flip in 12 months.

Conclusion – Positioning for Growth

The bottom line: Amazon's expansion on San Antonio's East Side isn't just a headline – it's a signal. It signals job growth, infrastructure investment, and East Side housing market growth to come.

For buyers and investors, that means now is a smart time to position yourself before values climb.

If this story resonates with your homebuying or investing plans, let's talk strategy. I specialize in military relocations and San Antonio neighborhoods, and I can help you identify the right blocks, builders, and timing.

Send me a message or call (210-997-0763) and we'll make sure your move is a smart one.

Frequently Asked Questions

What is the outlook for real estate in San Antonio, Texas?

Experts see a stable market with modest gains. Recent data show solid sales growth (up 19% in Oct 2024) and fairly flat home prices.

Many local forecasts expect low single-digit appreciation in 2025, driven by job growth and healthy inventory. In short, demand remains strong but extreme price spikes have cooled.

Is Amazon involved in real estate?

Yes. Amazon owns and leases thousands of warehouses, distribution centers, and data centers nationwide. These are often in industrial parks and near highways (as we see on the East Side).

When Amazon invests in a facility, it's effectively acquiring real estate for logistics operations – like the Rosillo Creek warehouse we discussed.

How much real estate does Amazon own?

While Amazon's exact holdings fluctuate, the company's network includes hundreds of fulfillment centers, sortation centers, delivery stations, and data hubs across the U.S.

In Texas alone it has dozens of sites (Dallas, Austin, San Antonio regions, etc.). Their real estate footprint is massive – Amazon's own reports say they've invested billions in physical infrastructure – but they don't disclose an exact property count publicly.

Is Jeff Bezos buying up single family homes?

Not to my knowledge. Media reports suggest Amazon (and its leaders) focus on large-scale logistics and tech investments, not filling neighborhoods with personal purchases.

Bezos has bought farms and mansions, but there's no evidence he's buying homes en masse. The real estate impact here is from Amazon the company, not Bezos the person.

What is the housing forecast for San Antonio in 2025?

Analysts predict a balanced market. Mortgage rates should stay relatively high (around ~6%), which will keep demand in check.

Most forecasts (including local MLS and economist reports) call for mild appreciation (2–5%) or stable prices in 2025. Essentially, strong job growth (like from Amazon and JBSA) will support values, but new listings and interest rates give buyers some breathing room.

A recent SABOR report showed median prices inching up only ~1.6% YOY.

What is the most desirable neighborhood in San Antonio?

Desirable depends on your needs! Generally, top areas include Alamo Heights, Stone Oak, The Dominion, and near military bases for families. These neighborhoods offer good schools and amenities.

For growth potential on the East Side, look at suburbs like Schertz/Cibolo or Selma, which have more affordable homes but easy access to jobs. Always consider commute, schools, and future development when choosing the best spot.

Categories

Recent Posts

Leave a Reply