How to Buy a Home with Little to No Money Down in San Antonio

You've probably heard you need 20% down to buy a home in San Antonio. That's a myth I bust every single day. As a US Air Force veteran and San Antonio Realtor specializing in military relocations, I've helped hundreds of buyers get keys to their new home with zero or very low down payments.

The truth is, if you know which programs to use, you can buy a home with little to no money down in San Antonio right now. I'm Anthony Sharp with Sharp Realty Group TX, and I've spent years helping veterans, first-time buyers, and relocating families navigate these exact programs.

The median home price in San Antonio sits around $310,000 as of 2025. While that might sound intimidating, the right loan program means you won't need $62,000 sitting in your bank account.

Watch My Full Video Breakdown

I recorded a detailed video walking through exactly how San Antonio buyers are getting into homes without massive down payments. In this video, I break down the three main programs, eligibility requirements, and common mistakes that cost buyers thousands.

If you're serious about buying with zero down, this 10-minute video will save you hours of research and potentially tens of thousands of dollars.

Watch the full video here:

Ready to Make Your Zero-Down Move?

Don't let down payment myths keep you renting. Whether you're a veteran, first-time buyer, or relocating to San Antonio, I'll walk you through every program you qualify for and find the right home that fits your budget.

Contact Sharp Realty Group TX today at http://sharprealtygrouptx.com/ and let's get you preapproved and house hunting.

VA Loans: The Most Powerful Zero-Down Option

VA loans are hands down the best tool for veterans and active duty service members buying in San Antonio. These loans let you purchase with absolutely zero down payment, no private mortgage insurance, and competitive interest rates that often beat conventional loans.

I use my own VA benefit. I help fellow veterans maximize theirs every week.

The VA limits closing costs by law, so you won't get blindsided by hidden fees at the table. For 2025, the standard county loan limit in San Antonio is $806,500, which covers virtually every home in our market.

You'll need a Certificate of Eligibility, but I walk my clients through that process in about 15 minutes. The real benefit here isn't just the zero down, it's that you avoid PMI entirely, which saves most buyers $100 to $300 per month compared to conventional loans with less than 20% down.

VA loans are also assumable. When you sell, a qualified buyer can take over your loan and rate. In today's market, that's a massive selling advantage.

USDA Loans for Eligible San Antonio Areas

USDA loans are another zero-down option that gets overlooked, especially by buyers looking in suburban and rural areas around San Antonio. These loans are designed for properties in eligible locations outside the urban core, and they offer zero down payment with interest rates that often beat conventional loans.

San Antonio has dozens of USDA-eligible communities. Neighborhoods in areas like 78245, 78254, 78261, and 78263 qualify for USDA financing, with homes ranging from the $200s to $600s.

There are income limits, USDA is designed for moderate-income buyers, but if you qualify, it's one of the smartest ways to buy without draining your savings. The other advantage is that USDA loans don't require monthly mortgage insurance like FHA loans do.

You'll pay a small upfront guarantee fee that can be rolled into your loan, but your monthly payment stays lower.

First-Time Homebuyer Programs in San Antonio

Texas offers some of the best first-time homebuyer assistance programs in the country. San Antonio has local programs that stack on top of state options.

The City of San Antonio runs two Homeownership Incentive Programs, HIP 80 and HIP 120, that provide real money to cover down payments and closing costs.

-

HIP 80 offers up to $30,000 in assistance for lower-income buyers. The loan is 100% forgivable after 10 years if you stay in the home. For 2025, income limits range from $54,150 for one person to $102,100 for eight people, with purchase price caps of $263,000 for existing homes and $278,000 for new construction.

-

HIP 120 provides up to $15,000 for moderate-income buyers, with 75% forgivable over 10 years. Income limits go up to $81,150 for one person, and you can purchase homes up to $305,200 for existing or $325,800 for new builds.

Both programs require completing a HUD-approved homebuyer education class. You must purchase within San Antonio city limits.

At the state level, the Texas State Affordable Housing Corporation offers programs like My First Texas Home. This provides 30-year low-interest mortgages plus up to 5% assistance for down payment and closing costs.

Your Next Step: Let's Talk Programs

I've helped clients stack these programs to cover nearly every dollar of their closing costs. If you're wondering which programs you qualify for or which San Antonio neighborhoods give you the best options, let's talk.

Visit Sharp Realty Group TX at http://sharprealtygrouptx.com/ or call me directly. I'll get you preapproved with a lender who specializes in these programs and start finding homes that fit your goals.

Common Misconceptions About Zero-Down Loans

The biggest myth I hear is that zero down means you're buying a lower-quality home or taking on more risk. That's completely false.

In San Antonio, buyers using VA, USDA, and first-time buyer programs purchase in brand new developments, established neighborhoods, and everything in between with no compromise on quality.

Another misconception is that you can't combine assistance programs. In reality, you can often stack local and state programs to maximize your benefits. I've had clients combine HIP assistance with state programs to cover both down payment and closing costs entirely.

You just need a realtor and lender who know how to structure the deal correctly.

Some buyers also think zero down automatically means higher interest rates. That's not true for VA and USDA loans, which often offer rates competitive with or better than conventional loans.

Tips for Buying Success

-

Check your eligibility early and get preapproved before you start looking at homes. Preapproval tells you exactly how much you can borrow and shows sellers you're a serious buyer.

-

Understand the full cost of homeownership beyond the down payment. Property taxes in Bexar County, HOA fees, homeowners insurance, and maintenance all factor into your monthly budget. I help my buyers run these numbers so there are no surprises after closing.

-

Keep your credit clean and avoid major purchases before closing. Opening new credit cards, financing a car, or making large withdrawals can kill your loan approval even after you're under contract.

-

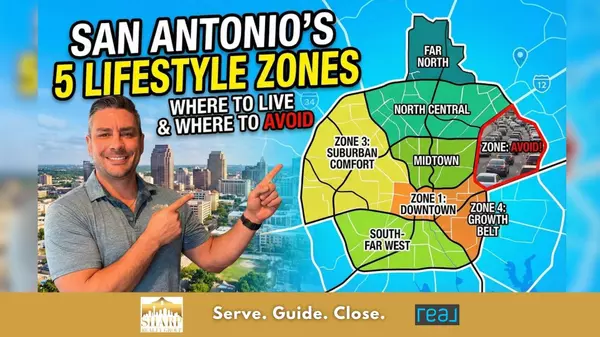

Pick the right neighborhood for your needs and commute. San Antonio is a large metro area, and commute times vary dramatically depending on where you work. I help buyers narrow down target areas based on job location, schools, and lifestyle before we ever schedule showings.

Frequently Asked Questions

Can I really buy a home in San Antonio with zero down?

Yes. VA loans and USDA loans both allow zero down payment for eligible buyers.

First-time buyer programs like HIP 80 and HIP 120 can cover down payments and closing costs up to $30,000, effectively bringing your out-of-pocket to near zero.

Do I need to be a first-time buyer to qualify for zero-down programs?

Not always. VA loans are available to all eligible veterans and service members regardless of whether you've owned a home before.

USDA loans don't require first-time buyer status either. Some city and state programs do require you haven't owned a home in the last three years.

What areas of San Antonio qualify for USDA loans?

USDA eligibility covers suburban and rural areas outside the urban core. In San Antonio, this includes parts of ZIP codes 78245, 78254, 78261, and 78263, among others.

Eligibility changes as areas develop, so check with a USDA-approved lender for current maps.

Will I pay higher interest rates with zero down?

Not necessarily. VA loans typically offer competitive rates with zero down and no PMI.

USDA loans also offer favorable rates for eligible buyers. Your credit score, income, and debt-to-income ratio impact your rate more than your down payment amount.

Can I use down payment assistance and a VA loan together?

In most cases, no, VA loans already offer zero down, so additional down payment assistance isn't necessary. However, you can use grant programs to help cover closing costs or other expenses.

I help veterans explore all options to minimize out-of-pocket costs.

Make Your San Antonio Move Sharp

Buying a home with little to no money down in San Antonio isn't just possible, it's happening every single day. I've personally walked dozens of veterans, first-time buyers, and relocating families through VA loans, USDA loans, and local assistance programs that make homeownership accessible.

You don't need to wait years to save a massive down payment.

The key is knowing which program fits your situation, getting preapproved with the right lender, and having a realtor who understands how these programs work in practice. I've built my business on military relocations and helping buyers maximize every dollar.

I'd be honored to help you do the same.

Ready to stop renting and start building equity? Contact me at Sharp Realty Group TX today at http://sharprealtygrouptx.com/. Let's talk about your goals, run the numbers, and get you into the right San Antonio home with zero or low money down.

Welcome to San Antonio, let's make your move a sharp one.

Categories

Recent Posts