Planning to Buy a Home in San Antonio in 2026? Avoid These 10 Crucial Mistakes

If you're among the first-time homebuyers in San Antonio 2026, I'm here to share hard-earned wisdom from years of helping folks find their Texas dream home. Think of this as your personal guide to avoiding the pitfalls that trip up buyers.

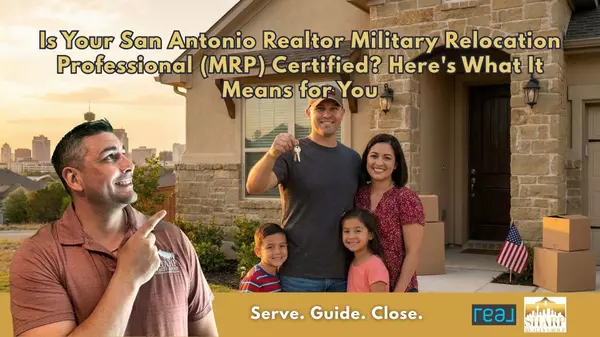

Hello there! Anthony Sharp here – a proud U.S. Air Force veteran turned San Antonio Realtor and military relocation specialist.

Understanding San Antonio's 2026 Market

San Antonio's a fantastic place to settle down. Our city currently has a healthy housing supply of ~5.6 months, and homes spend longer on market (averaging over 80 days) compared to other big metros.

Prices have even dipped slightly (~3–4% year-over-year) around 2025, making San Antonio relatively affordable. Typical home values here (~$248K) sit well below the national median, and homes take about 46 days to go under contract on average.

This means buyers now have breathing room. But don't let a calmer market fool you – mistakes can still derail your purchase, especially with potential interest rate changes ahead.

10 Common Home Buying Errors in San Antonio (2026)

Mistake #1: House-Hunting Before Mortgage Pre-Approval

What Happens: You find the perfect San Antonio home – only to lose it because your financing isn't lined up. Many buyers look for homes without getting pre-approved for a mortgage.

In a market like San Antonio, shopping without a pre-approval letter is like going fishing without bait. Sellers won't take your offer seriously if you can't show you're financially ready.

How to Avoid It: Get pre-approved with a lender before you even search listings. This involves a quick review of your income, credit, and savings to determine how much house you can afford.

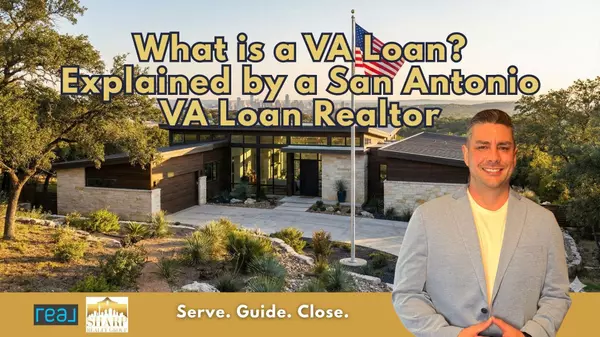

Pre-approval strengthens your offer and prevents heartbreak by setting a realistic budget. If you're a veteran or active-duty, talk to a lender experienced with VA loans – your buying power might surprise you with $0 down options.

Don't settle for the first quote. Nearly 54% of homebuyers only get one mortgage quote, costing them hundreds of dollars monthly. Shopping around for a mortgage can save you $600–$1,200 per year, or ~$84,000 over the life of the loan.

Down Payment Reality vs Myth

A comparison of down payment percentages for first-time buyers, repeat buyers, and common myths.

Mistake #2: Believing You Need a 20% Down Payment

What Happens: Many would-be buyers put off purchasing because they think they must have 20% down. I've met San Antonians renting for years, waiting to hit that magic number.

Meanwhile, home prices rise and they miss out on building equity. The truth? This is a myth for most first-time buyers.

According to the National Association of REALTORS®, typical first-time homebuyers put only 6%–9% down – it's never been 20% in modern history! In 2024, repeat buyers did around 23%, but first-timers were in the single digits.

How to Avoid It: Don't let the 20% myth stall your dreams. Explore low down payment loan programs: FHA loans can be as low as 3.5% down, and VA loans (for veterans and active-duty) allow 0% down.

About 29% of first-time buyers use FHA and 9% use VA loans nationwide. There are also Texas and local down payment assistance programs for San Antonio buyers.

I've seen clients purchase sooner and start building equity with just a few thousand dollars down. If you have 20% ready, that's great – you'll avoid PMI. But don't let a smaller savings pot keep you out of homeownership.

Mistake #3: Not Using Your VA or First-Time Buyer Benefits

What Happens: Some buyers don't realize the programs available or shy away due to misinformation. I've met service members who didn't use their VA loan because "they heard it's a hassle."

I've also seen first-time buyers ignore programs like TSAHC or NACA that could've made their purchase easier. Not leveraging these benefits is leaving money on the table.

How to Avoid It: Do your homework to identify buyer programs you qualify for. If you're military or a veteran, the VA loan is hands-down one of the best tools – zero down payment, no PMI, and historically low rates.

Despite rumors, VA loans close as reliably as other loans when handled correctly. Sellers can even pay some of your costs (up to 4% in concessions).

For first-time civilian buyers, look into FHA loans, state assistance programs, or USDA loans if you're considering outskirts. Take advantage of the help out there – you earned those benefits.

🎥 Watch: STOP WAITING! These San Antonio Neighborhoods are the Smartest Buy for 2026

Watch my in-depth video guide where I break down the best neighborhoods to invest in, covering median home prices, top school districts, and growth potential for 2026.

Watch the Full Video Guide →

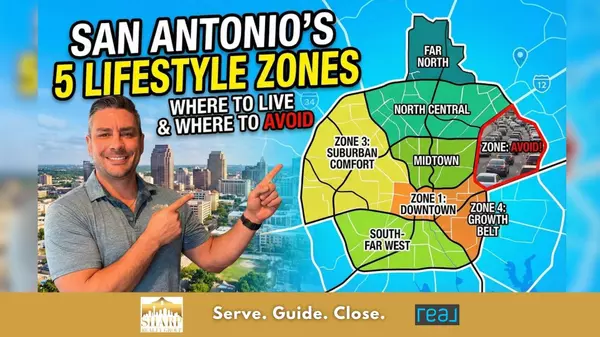

Watch the Full Video Guide → Mistake #4: Skipping Neighborhood Research and Local Market Trends

What Happens: You fall in love with a house and only later realize the commute is brutal, property taxes are sky-high, or the area doesn't vibe with your lifestyle. In San Antonio, neighborhoods vary dramatically – Alamo Ranch is very different from Alamo Heights.

Not researching school districts, crime rates, upcoming developments, or utility reliability can be a regret waiting to happen. Also, ignoring market data is a mistake.

Some buyers rely on outdated national headlines and may not realize San Antonio's market cooled in 2025 (homes taking 2+ months to sell on average). Those local trends affect how you strategize your purchase and negotiations.

How to Avoid It: Do your due diligence on both the house and its surroundings. Visit the neighborhood at different times of day and check commute routes.

Research property tax rates – some nearby counties like Comal or Guadalupe might have different rates than Bexar. If you're using a VA loan and claiming a homestead, you may get a property tax break or full exemption if you're a disabled vet.

For market trends, ask your agent for the latest data. As of late 2025, San Antonio had ~6 months of housing supply and an average DOM over 80 days, signaling a buyer-friendly market. Median sale price was around $289K as of Aug 2025.

Knowing this, you might realize you have room to negotiate. Buying a home is not just about the house, but the whole lifestyle and future resale value.

Mistake #5: Overextending Your Budget & Ignoring Hidden Costs

What Happens: You get pre-approved for $450,000 and decide to max it out. Or you only calculate principal and interest, forgetting that owning a home in Texas means hefty property taxes and insurance.

Then closing time comes and you're hit with reality – higher monthly payments, closing costs, moving expenses. I've seen buyers stretched so thin they couldn't furnish the house or build an emergency fund.

While Texas lawmakers passed property tax relief in 2023–2024, the overall cost of homeownership still rose ~2.7% in 2024 due to spikes in insurance and utilities. The median Texas homeowner's monthly costs hit $1,452 in 2024 (about 22% of income).

How to Avoid It: Buy below your maximum budget if possible – leave wiggle room. Keep housing payments under ~30% of your gross income (many aim for ~25%).

When estimating monthly costs, include property taxes, homeowner's insurance, HOA fees, and maintenance. In San Antonio, property tax rates can be around 2%–3% of the home's value annually. So a $350K home could run ~$7K-$10K/year in taxes ($600-$800/month).

Plan to set aside 1% of the home's value per year for maintenance. I always sit down with my buyers and create a full budget: mortgage + taxes + insurance + average utilities + maintenance fund.

Also, watch out for closing costs – in SA, buyers often pay ~2-5% of the purchase price. One more tip: don't make big purchases or open new credit during the homebuying process. Keep your financial picture steady until you have the keys!

Mistake #6: Waiving the Inspection or Skimping on Due Diligence

What Happens: In red-hot markets, buyers sometimes waived inspections to win bidding wars. While 2026 San Antonio isn't as crazy as 2021, I still see eager buyers tempted to skip inspections.

Maybe the house looks flawless, or Uncle Bob gave it a once-over, so you think you're good. Then after move-in, the sewer line backs up or the roof starts leaking – and now it's your $10,000 problem.

Even new construction can have issues. Another angle: not reading HOA rules or deed restrictions. You'd hate to learn after closing that you can't park your boat in the driveway.

How to Avoid It: Always get a professional home inspection. Spend that $300–$500; it's the best insurance before you commit hundreds of thousands.

Attend the inspection if you can – you'll learn a ton about the house. In Texas, option periods (due diligence periods) are common – use that window to negotiate repairs or back out if something major comes up.

For new builds, do a phase inspection or at least a final inspection. Review all seller disclosures carefully – Texas requires sellers to disclose known issues.

Read the HOA bylaws if there's a homeowners association. If the property is rural or on the edge of town, check for county restrictions or flood zone concerns.

Mistake #7: Taking Forever to Pull the Trigger (or Rushing In Too Fast)

What Happens: This mistake is two sides of the same coin. Some buyers hesitate endlessly, waiting for the "perfect" house or convinced a market crash is coming.

Analysis paralysis can be costly. I've had clients who waited so long expecting prices to drop dramatically, but San Antonio's market tends to steadily appreciate (3-4% annual gains forecast for 2025-2026).

On the flip side, some folks rush in due to FOMO. Maybe you go to one open house and feel pressure to bid immediately, skipping proper vetting. Impulsive buys can lead to regret.

How to Avoid It: Find a balance with your timing. Stay informed but recognize you'll never time things perfectly.

If you have your finances in order and a clear picture of what you need, don't be afraid to act when you find a great match. As of 2026, we expect a moderate market – not a free-fall crash, not a crazy boom.

One forecast expects San Antonio home prices to rise about 4% in 2026, not drop. My advice: if you're ready, buying sooner is often better because you start building equity and hedge against rising costs.

However, don't let anyone rush you into a home that's not right. If a house meets 85% of your needs and you feel good about it, go for it. If you're unsure, it's okay to pass.

Mistake #8: Forgetting Future Plans – Resale and Rentability

What Happens: You buy a home that fits today but not tomorrow. Maybe you're a young couple who buys a trendy downtown condo, but then baby #1 is on the way and suddenly you need a yard and good schools.

As a military family, you might purchase without thinking about resale potential when PCS orders come. I've seen folks buy quirky fixer-uppers only to realize few other buyers want them – making it tough to sell or rent.

How to Avoid It: Think 5+ years down the road. Even if you plan to live in the home long-term, life can change.

Ask yourself: If I needed to sell this home in a few years, would others want it? Consider location desirability, school district (even if you don't have kids, it affects value), and layout.

For military buyers, I recommend choosing a property that can be easily rented out or sold when you get orders. Something near Joint Base San Antonio or major job hubs, with broad appeal, can become a great investment property later.

Think about your personal future too. Are you planning to expand your family? Will an aging parent possibly live with you? Might you work from home permanently?

Treat your home purchase partly as an investment. In San Antonio's steady market, a well-chosen home can appreciate nicely over time (~3% annually on average), especially as the city keeps growing.

Mistake #9: Not Working with an Experienced Local Agent (Trying to DIY)

What Happens: In the age of Zillow, some homebuyers think they can go it alone or they'll just call the listing agent. Without a dedicated buyer's agent, you might miss subtle issues or negotiation opportunities.

I've had clients come to me after failed solo attempts. The listing agent works for the seller – their job is to get the seller the best deal, not you.

How to Avoid It: Team up with a knowledgeable local Realtor® you trust. A good agent will educate you, advocate for you, and protect your interests at every step.

In Texas, buyers typically don't pay the agent's commission – it's usually covered by the seller. Your agent will help you avoid all the mistakes we've discussed: ensure you're pre-approved, keep you within budget, find red flags, and handle the 30+ page contract.

San Antonio has specific nuances like older homes with pier-and-beam foundations, or issues like aluminum wiring in vintage houses. A local pro stays on top of all that.

If you're military or relocating, an agent who's a military relocation expert can coordinate virtual tours, work around your PCS timeline, and do video walk-throughs when you can't be there. I've negotiated for buyers to get seller-paid closing costs, appliances, or repairs that saved thousands.

Mistake #10: Neglecting the Final Walk-Through and Post-Offer Steps

What Happens: You made it under contract – congrats! But some buyers skip the final walk-through (which happens a day or hours before closing) or do it hastily.

Later, they discover the seller removed fixtures they thought were included, or a plumbing leak arose after the sellers moved out. Another mistake is not reviewing closing statements carefully – maybe rates or fees aren't what you expected.

How to Avoid It: Stay vigilant through closing day. Always do a final walk-through to ensure the home is in the condition it should be: all agreed repairs completed, no new damage, and items that were supposed to remain are there.

Review your Closing Disclosure (CD) closely – you should receive it at least 3 days before closing. Check that the interest rate, loan amount, and all costs match what you were told.

Line up your home insurance to start on closing day and set up utility transfers. After closing, change your address officially and update any home warranty info.

I also recommend new owners re-key the locks right after closing. And celebrate! Buying a home is a big achievement.

Down Payment Tips

| 1 | Get Pre-Approved First |

| 2 | Don't Need 20% Down |

| 3 | Use VA/First-Time Benefits |

| 4 | Research Neighborhood |

| 5 | Budget for Hidden Costs |

| 6 | Always Get Inspection |

| 7 | Balance Your Timing |

| 8 | Think Resale Value |

| 9 | Hire Local Agent |

| 10 | Final Walk-Through |

San Antonio Real Estate Advice for 2026: Military Homebuyers Edition

San Antonio isn't nicknamed "Military City USA" for nothing. We're home to Joint Base San Antonio (JBSA) which includes Fort Sam Houston, Lackland AFB, and Randolph AFB, plus a huge veteran community.

Bexar County has nearly 160,000 veterans (about 11% of the population) and ~80,000 active-duty folks – almost 17% of residents have military ties. Here's how to avoid home buying errors that specifically catch military buyers off-guard:

PCS Timing Trap: Military orders often come with tight timelines. A big mistake is not aligning your home purchase with your PCS schedule.

Closing typically takes ~30-45 days from contract to keys. If you have only 60 days before you report, focus on move-in ready homes. New construction can be tempting, but if a build isn't complete in time, you could end up in temporary lodging.

Not Using BAH Wisely: Your Basic Allowance for Housing is a fantastic resource. A mistake is either overextending beyond your BAH or under-utilizing it.

San Antonio's BAH rates align with our cost of living, which is lower than many coastal bases. If your BAH covers a $2,000/month payment and you find a home that fits within that, you're building equity on Uncle Sam's dime.

A smart move: buy below your max BAH, then save the difference for maintenance/upgrades. That way you build equity and have a cushion.

Ignoring Resale/Rental Value near Bases: Choose a property that will be easy to sell or rent to other military families when you PCS again. Homes within a 30-minute drive of the bases are always in demand.

Being in a good school district (Northside ISD, Northeast ISD, Schertz-Cibolo) is a plus since many military families have kids. Consider 3-4 bedrooms, a fenced yard, and not too high-maintenance.

Choosing the Right Loan and Lender: Make sure you're working with a lender who truly understands VA loans. Be aware of Texas VLB (Veterans Land Board) programs if you're a Texas resident vet.

Use every resource your service has earned you and work with professionals who appreciate the military lifestyle.

Overlooking Texas Veteran Benefits: Texas offers perks like property tax exemption for 100% disabled veterans, and partial exemptions based on disability rating. It's a mistake not to file for these.

If you have a disability rating, apply for your Texas residence homestead exemption and the vet exemption as soon as you close. This can save thousands every year.

San Antonio Home Buying FAQs 2026

Q: Is 2026 a good time to buy a house in San Antonio?

A: Yes – 2026 is shaping up to be favorable for buyers compared to the pandemic years. The market is more balanced now with ~5.6 months of inventory. Prices have moderated with slight declines in 2025 (~3-4% year-over-year).

Experts forecast modest price growth (around 3-4%) going into 2026, not a spike. San Antonio's strong economy, job growth, and continued military presence support the housing market. The current conditions offer a window where buyers aren't having to waive everything to get a home.

Q: What are the top home buying mistakes to avoid in San Antonio?

A: The top mistakes are: (1) Not getting pre-approved before house-hunting. (2) Overextending your budget without accounting for Texas taxes and insurance. (3) Skipping the inspection or due diligence.

Also avoid: (4) Waiting for a "unicorn" perfect home or perfect market. (5) Not using your resources like VA loans if eligible or working with a knowledgeable Realtor. How to avoid home buying pitfalls in San Antonio comes down to preparation, research, and having the right team guiding you.

Q: How is the San Antonio real estate market in 2026?

A: The San Antonio real estate market 2026 is expected to be stable and buyer-friendly. Inventory is healthy with homes staying on market 50-60 days on average. The median price was around $295K in late 2025, with predictions calling for modest appreciation by late 2026.

Because of increased supply, buyers often have leverage to negotiate repairs or closing cost credits. Good homes in hot locations can still attract multiple offers. Interest rates were in the 6-7% range in 2025; if they drop into the 5s by late 2026, that could spur more buyer activity.

Q: What first-time homebuyer mistakes should I watch out for?

A: Key mistakes for first-timers include not preparing financially, believing you need 20% down (typical down payments are much lower), and letting emotion rule entirely. Skipping homebuyer education and not comparing mortgage offers are also common errors.

Only 22% of buyers get 2+ mortgage quotes, but those who do save significantly. Don't wait too long because of fear – educate yourself, get a good agent, and trust the process.

Q: What does the San Antonio home buying process look like?

A: The San Antonio home buying process 2026 includes: (1) Preparation – check credit, start saving, research neighborhoods. (2) Pre-Approval – connect with lender. (3) Hire Your Agent. (4) House Hunting – mix of in-person and virtual tours. (5) Making an Offer – craft a strong offer with your agent.

The process continues with: (6) Under Contract – put down earnest money and option fee, schedule inspection. (7) Due Diligence – review inspection, negotiate repairs. (8) Appraisal & Financing – bank's appraisal comes in, finalize loan. (9) Closing Prep – review Closing Disclosure, arrange funds, do final walk-through. (10) Closing Day – sign papers at title company, get keys! From start to finish: 30 days to a few months depending on your pace.

Q: Any extra San Antonio real estate advice for 2026?

A: Take a long-term perspective. San Antonio is a city where real estate builds wealth steadily over time. If you buy a home you can comfortably afford in an area you like, it's hard to go wrong long-term.

Stay informed but don't get overwhelmed by national news – focus on local sources like the San Antonio Board of Realtors. Lean on professionals with experience and trustworthiness. Most importantly, enjoy the journey – drive around neighborhoods, try local restaurants, talk to locals, and soon you'll be enjoying your new home.

I hope this guide helps you feel more prepared about buying a home in San Antonio in 2026. I wrote this from experience – both as a veteran and as a Realtor® who has seen it all. By avoiding these crucial mistakes and heeding insider tips, you'll be far ahead of the pack.

Remember: I'm here as a resource. If you have questions or want personalized advice, don't hesitate to reach out. Helping homebuyers (especially fellow service members) is what I love to do.

Here's to smart home buying and a smooth landing in Military City USA! 🏠 ✨

Categories

Recent Posts