20 Expert Tips for First-Time Homebuyers in San Antonio in 2026

Buying your first home as one of the first-time homebuyers in San Antonio 2026 can be both exciting and overwhelming. As a U.S. Air Force veteran turned Realtor®, I've been in your shoes and helped many navigate this journey successfully.

I've compiled 20 expert tips to guide you step by step, from budgeting to moving in – including special advice for military families near Randolph AFB. Let's get started!

1. Understand the 2026 San Antonio Housing Market

Before diving in, get to know San Antonio real estate for first-time buyers. The market in 2025–2026 is stabilizing after a hot few years.

Current Market Conditions: Inventory has grown to a balanced level (about 5–6 months of supply), meaning you have more homes to choose from and more negotiating power. Median home prices hover around $315,000 – much more affordable than Austin ($525,000) or Dallas.

What This Means for You: San Antonio remains Texas' most affordable big metro. Prices are slowly inching up (about 2-4% year-over-year) and interest rates are around 6%. The 2026 market should be more "normal" – homes taking longer to sell, with sellers often willing to offer concessions.

You won't face 50-person bidding wars like in 2021, but you should still be strategic. Keep an eye on monthly reports from the San Antonio Board of REALTORS® for the latest trends.

2. Get Your Financial Ducks in a Row

Total Monthly Payment Breakdown

A breakdown of the total monthly payment with individual category amounts and percentages.

Before looking at houses, take a close look at your finances. Set a realistic budget based on what you can afford monthly for mortgage, taxes, insurance, and upkeep.

Budget Guidelines: Your total housing payment should be no more than 30% of your gross income. In Texas, property taxes are higher than the national average, so factor that in carefully.

Credit Score Matters: Most first-time homebuyers need a credit score around 620 or higher. FHA loans can accept scores around 580, but a higher score (660+) gets you better rates.

Save for Multiple Costs: Don't just save for the down payment (which can be as low as 3-5%). Closing costs typically add another 2–5% of the purchase price. Having extra savings helps with unexpected repairs after you move in.

Pay down small debts and avoid major purchases or credit inquiries for several months before applying for a mortgage. Don't buy a new car or open credit cards right before buying a home!

3. Get Pre-Approved and Explore Mortgage Options

Loan Type Comparison

| Loan Type | FHA Loan | Conventional | VA Loan | USDA Loan |

|---|---|---|---|---|

| Down Payment | 3.5% | 3% | 0% | 0% |

| Minimum Credit Score | 580+ | 620+ | 600+ | 640+ |

| PMI/Mortgage Insurance | Yes (lifetime) | Yes (removable) | No | Yes |

| Best For | Moderate credit | Good credit | Veterans/Military | Rural areas |

A comparison of different loan types and their features to help you decide the best fit for your homebuying journey.

Get pre-approved for a mortgage early. This shows sellers you're serious and tells you exactly how much house you can afford.

Common Loan Types:

Conventional Loans (3% down): Great if you have good credit (620+). PMI can be removed later.

FHA Loans (3.5% down): Popular for first-timers with moderate credit. More flexible but has mortgage insurance for the life of the loan.

VA Loans (0% down): Fantastic for veterans and active-duty military. No down payment, no PMI, competitive rates.

USDA Loans (0% down): For more rural areas around San Antonio. Parts of Comal or Guadalupe County might qualify.

Pro Tip: Compare rates from at least two lenders. Even a 0.25% lower rate can save you thousands over time. Ask about first-time buyer incentives like lender credits or rate buydowns.

In 2026, some lenders or builders may offer to buy down your rate for the first couple of years or help with closing costs.

4. Research First-Time Homebuyer Programs

HIP Programs

There are programs that can give you thousands toward your first home. The biggest program in San Antonio is the Homeownership Incentive Program (HIP).

HIP Program Details:

HIP 80: For households earning ≤80% of area median income. Provides $1,000 to $30,000 in down payment assistance as a 0% interest loan. It's fully forgivable over 5–10 years if you live in the home.

HIP 120: For moderate-income households (up to ~120% of AMI). Offers $1,000–$15,000 with 75% forgiven over 10 years.

These funds can cover your down payment and closing fees. Only homes within San Antonio city limits qualify, and you'll need to complete a HUD-approved homebuyer education course.

State Programs: The My First Texas Home program provides down payment assistance (3-5% of loan amount) and low fixed-rate mortgages. The Texas State Affordable Housing Corp (TSAHC) offers Home Sweet Texas and Homes for Texas Heroes programs.

"Texas Heroes" is aimed at teachers, police, firefighters, and military veterans. If you're in these groups, you might get mortgage credit certificates (MCC) to save on federal taxes.

Important Note: You may have heard of the "Biden grant" for first-time buyers ($25,000 Down Payment Toward Equity Act). As of late 2025, this federal program has been introduced but not passed into law yet. Don't count on that money. Focus on programs that exist now.

5. Build Your Homebuying Team

Buying your first home is easier with an expert team. As a buyer, hiring an agent usually costs you nothing out of pocket (the seller typically pays the commission).

What a Good Realtor Does:

- Educates you on the San Antonio home buying process step by step

- Finds homes that fit your criteria and provides off-market leads

- Writes strong offers and negotiates on your behalf

- Navigates paperwork and includes protective contingencies

Beyond your agent, your lender is crucial. Also line up a home inspector when needed and perhaps a real estate attorney for extra peace of mind at closing.

The key is trust and communication. You should feel comfortable asking any question. I've been through this personally with military moves, so I understand from both perspectives.

6. Make a Wish List – But Keep It Realistic

Define what you want in a home, but remember your first home is likely a starter home, not your forever mansion.

Create Two Lists:

- Must-haves: 3 bedrooms, 2 bathrooms, safe neighborhood, reasonable commute

- Nice-to-haves: Big backyard, updated kitchen, specific school district

In San Antonio, you can find affordable homes with great features, but you might not get everything on a limited budget – and that's okay!

Focus on What You Can't Change: You can change paint color, flooring, even knock down walls later. But you can't move the house off a busy road or make a tiny lot bigger. Prioritize location, layout, and structural basics over cosmetic details.

Consider your future needs for the next 5+ years. Are you planning to grow your family? Need a home office? Get a place you can grow into a bit, but don't overstretch your budget.

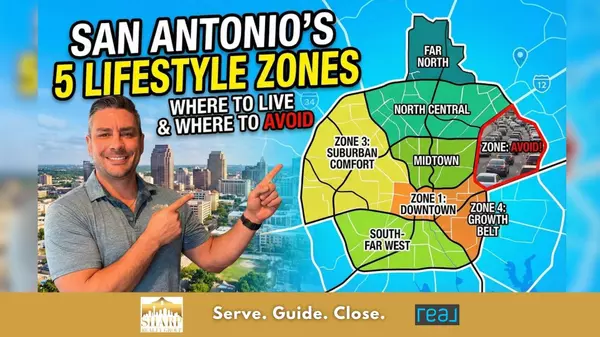

7. Research Neighborhoods and Locations

San Antonio is a big city with diverse neighborhoods. Think about location – it truly matters.

Popular Areas for First-Time Buyers:

Schertz/Cibolo/Universal City (Northeast): Near Randolph AFB. Newer homes, good schools, family-friendly. Often find 3-4 bedrooms in the $250K-$350K range.

Converse/Kirby/Windcrest (East/Northeast): Closer to San Antonio proper, near Randolph and Fort Sam. Solid starter homes, often under median price.

Alamo Ranch & Far West Side: Near Lackland AFB. Lots of new construction, shopping, amenities. Great "bang for buck" but mind the commute if working downtown.

Northwest/Leon Valley: Established neighborhoods, affordable homes, big trees, suburban vibe near Medical Center.

Central/Inside Loop 410: For young professionals wanting city life. Smaller, older homes near Pearl Brewery and Brackenridge Park.

Research Important Factors: Check crime rates, school ratings, and property tax rates. Drive through neighborhoods at different times of day. Check commute times and if the area is in a floodplain.

Remember, you can change a house but not its location. Buying in a good location can pay off when you sell later.

8. Follow a Homebuyer Checklist and Timeline

Home Buying Timeline

| Icon | Title | Time Frame | Description |

|---|---|---|---|

| 📅 | Get Pre-Approved | Before house hunting | 2-4 weeks |

| 🏠🔍 | House Hunting | Start searching | 2-8 weeks |

| 📝 | Make Offer | Found your home | 1-3 days |

| 🔍🏠 | Inspection Period | After offer accepted | 7-10 days |

| 💲 | Appraisal & Underwriting | Processing loan | 2-3 weeks |

| 🔑 | Closing Day | Sign & move in | 1 day |

Total Timeline: 30-45 Days from Offer to Close

Quick First-Time Homebuyer Checklist:

- Save for down payment (3-5%) plus closing costs (2-5%)

- Check credit and get pre-approved

- Choose a knowledgeable Realtor®

- House hunting – tour homes and take notes

- Make an offer with earnest money and option fee

- Inspection period (5-10 days) – negotiate repairs if needed

- Appraisal and underwriting – don't make financial changes!

- Closing prep – arrange insurance, utilities, final walk-through

- Closing day – sign documents and get the keys!

- Move in and file for Homestead Exemption

This checklist is a roadmap. With increased inventory in 2026, transactions might have more wiggle room on timing. But always be responsive with everything – documents, scheduling inspections – to keep the deal on track.

9. Don't Skip the Home Inspection

Always get a home inspection. Even if the house looks flawless, an inspector checks things you might not notice – roof, foundation, electrical, AC, plumbing, appliances.

It typically costs $300–$500 and is money well spent for peace of mind.

Common Mistakes to Avoid: Don't waive inspection to make your offer "more attractive." In 2026's market, you likely won't need to skip it. If a seller pressures you not to inspect, that's a huge red flag.

Review the Report: Focus on major findings: foundation cracks, roof damage, active leaks, old HVAC, faulty wiring. Minor stuff like a dripping faucet can be fixed easily.

If major issues are found, you can ask the seller to fix them, request a price reduction or credit, or walk away during the option period and get your earnest money back.

Attend the Inspection: Come for a walkthrough with the inspector. It's like a crash course in your new home's systems. Learn where the breaker panel and water shutoff are located.

10. Be Prepared for All Costs

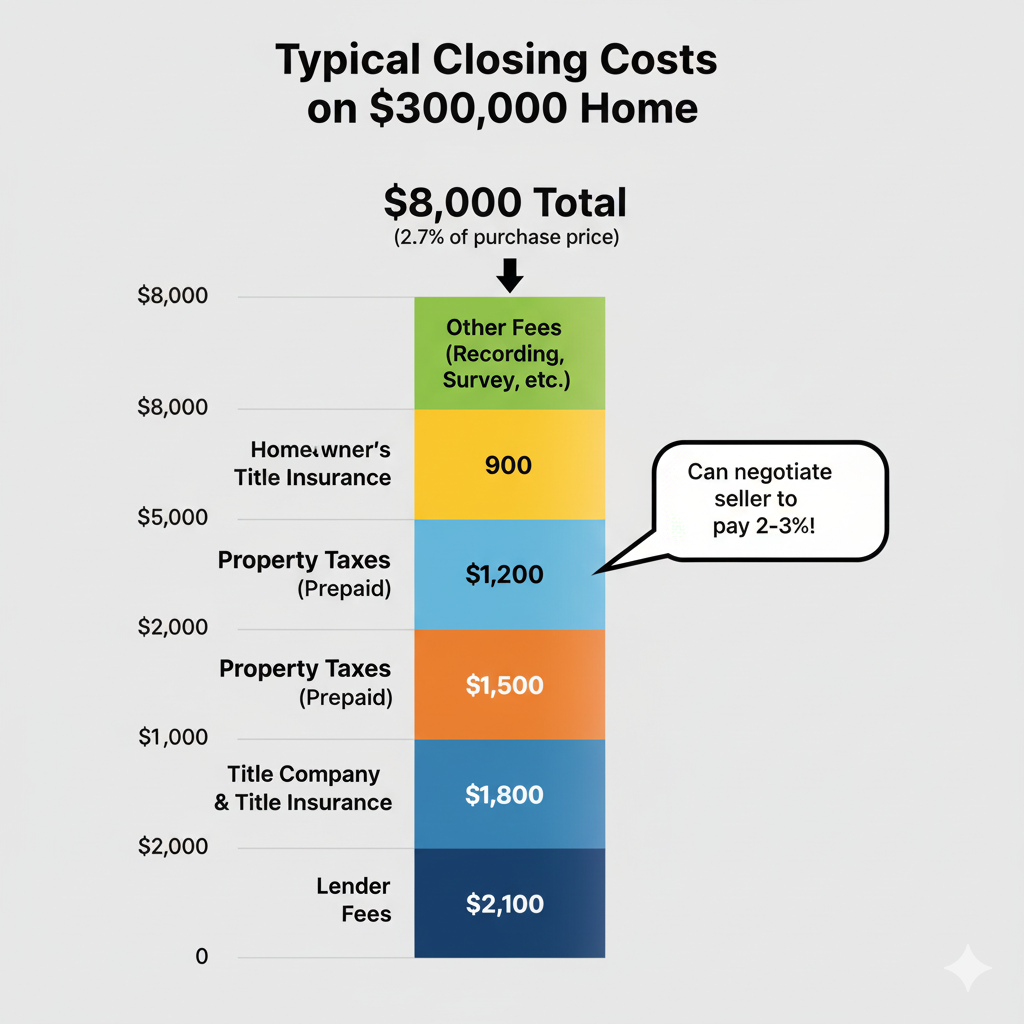

Many first-time buyers focus on the down payment but forget other costs.

Closing Costs: In San Antonio, closing costs for buyers usually run 2% to 5% of the loan amount. On a $300,000 home, that's $6,000–$10,000.

These include lender fees, title fees, title insurance, homeowner's insurance, property taxes, appraisal fee, and recording fees.

Pro Tip: Negotiate for the seller to pay some closing costs. In 2026's market, asking for 2-3% in seller concessions is common. That could save you thousands.

Ongoing Homeownership Costs:

- Property taxes and insurance (often in monthly payment)

- Utilities you didn't pay while renting

- Maintenance (set aside 1% of home's value annually)

- HOA fees if applicable

- Moving costs and initial improvements

Plan for the full picture. I'll help you estimate closing costs so you're not caught off guard. Being financially prepared for all aspects is what turns a first-time buyer into a confident homeowner.

11. Negotiate With Confidence

San Antonio's 2026 market gives first-time buyers leverage we haven't seen in a while. With inventory up and homes taking longer to sell, sellers are often eager to work with buyers.

What You Can Negotiate:

Price: Offer below asking if data supports it or if the home's been on market awhile.

Closing Costs: Ask the seller to pay a percentage of your costs to reduce cash needed.

Repairs: If inspection finds issues, negotiate repairs or credits.

Personal Property: Want the fridge or washer/dryer? Write them into the contract.

Home Warranty: Request the seller provide a one-year home warranty ($500 value).

Flexible Terms: Negotiate closing dates or occupancy timing.

Reports show an increase in seller concessions as a defining feature of the San Antonio market recently. Sellers are offering to pay points, throw in upgrades, or pay HOA dues.

Remember, negotiating isn't being pushy – it's finding a win-win. I'll present requests professionally with supporting data. The worst a seller can say is "no," and often they'll counter with something acceptable.

12. Plan for the Move and Transition

Moving Logistics: Schedule movers or truck early, especially at month-end when they're busy. Military members might use PCS entitlements. Get quotes if hiring professionals.

Set Up Utilities: Once you have a closing date, call utility companies 1-2 weeks prior. In San Antonio, set up CPS Energy (electric/gas), SAWS (water), internet/cable, and security if desired.

Change Your Address: Put in mail forwarding with USPS. Update your address on driver's license, bank accounts, and voter registration.

Closing Day Prep: Funding can take a few hours after signing. Don't schedule movers at exact closing time. Once the deed is recorded and sale funded, you get the keys!

After Moving In: Change the locks or rekey doors. Test smoke detectors and carbon monoxide alarms. Locate the main water shutoff and breaker panel.

Get to know your neighbors once you settle in. San Antonio is friendly, and good neighbor relationships make you feel more at home.

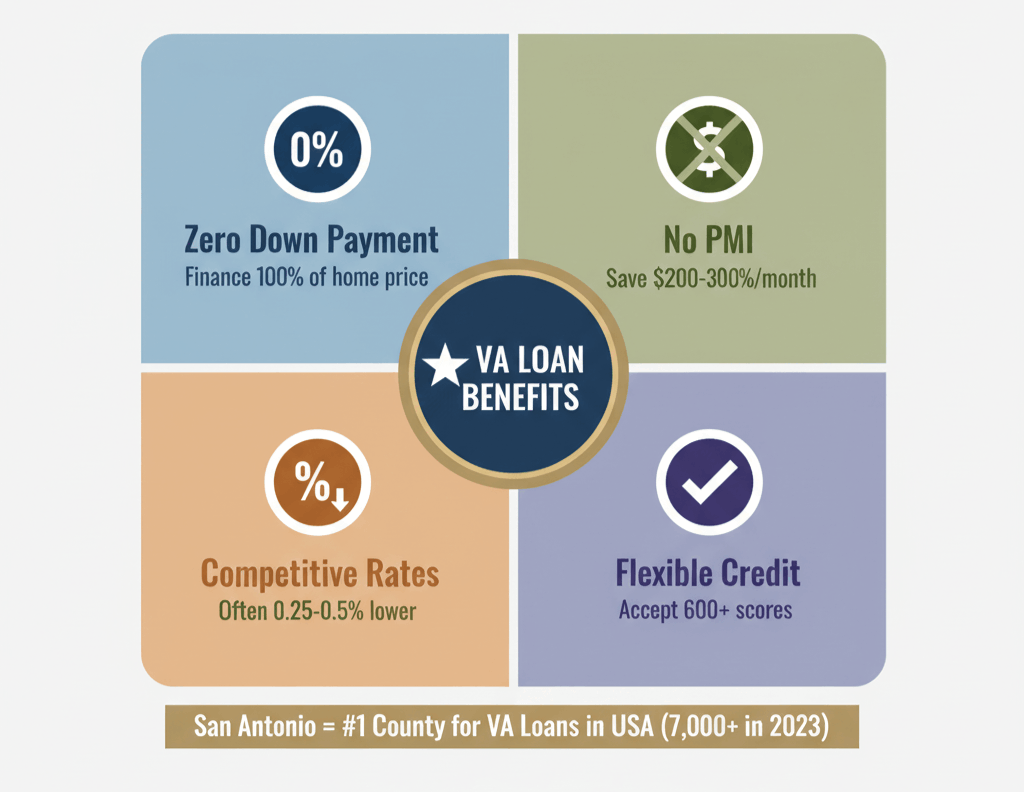

13. Leverage Your VA Loan (Military Buyers)

For veterans and active-duty members, VA Home Loans are one of the best benefits you've earned.

VA Loan Benefits:

- Zero Down Payment: Finance 100% of the home price

- No PMI: Saves hundreds monthly compared to other low-down loans

- Competitive Rates: Often as good or better than conventional

- Flexible Credit: Many lenders accept 600+ credit scores

San Antonio is a VA loan capital – in 2023, Bexar County had more VA home loans than any other county in the U.S. (over 7,000!).

Additional Resources: The Texas Veterans Land Board (VLB) program can offer even lower rates for Texas vets. Sometimes 0.5% discount if you have a service-connected disability.

The only real downside is the funding fee (2.15% for first-time use), but it can be rolled into the loan or waived if you receive VA disability compensation.

Maximize Your Benefits: Use your BAH as a guide for affordability. For example, an E-5 with dependents at JBSA-Randolph has BAH around $1,950. That roughly corresponds to a mortgage on a $250,000-$270,000 home.

I often help military clients find homes where the mortgage payment is at or below their BAH, so essentially their housing allowance builds equity instead of paying rent.

14. Plan Your PCS Timeline (Military Buyers)

Start Early: Contact a local realtor as soon as you get orders (even 6+ months out). We can discuss needs, get you pre-approved, and start sending listings.

House-Hunting Leave: Take advantage of permissive TDY (about 10 days). Plan a trip to San Antonio to tour homes intensively. Many families fly in for a weekend and leave under contract.

Embrace Virtual Buying: If you can't be here in person, I offer virtual showings via video call. Many military buyers successfully buy "sight unseen" except through virtual tours.

Timing Matters: Align your closing with your report date. Ideally close 1-2 weeks before starting work so you have time to move in.

Understand Commute Zones: If working at Randolph AFB, Schertz/Cibolo/Converse are prime (15-30 min). For Lackland, consider Alamo Ranch or Westover Hills. Choosing the right area saves hours in traffic weekly.

Consider Future Flexibility: Plan an exit strategy. Will you keep the home as a rental when you PCS next? I can advise on neighborhoods that rent easily.

My goal is to make your home purchase align seamlessly with your PCS. Let me handle the on-the-ground work so you can focus on your transition.

15. Connect with Local Resources

Tap into San Antonio's wealth of local resources and communities.

Homeowner Education: Consider taking homebuyer education classes offered by local nonprofits. They're typically low-cost or free and provide valuable knowledge about budget management and home maintenance.

Community Support: Join Facebook groups for first-time homebuyers in San Antonio. Share experiences, ask questions, and get recommendations for service providers.

Utilize Official Resources: Look at info from the National Association of REALTORS® (NAR) or U.S. Department of Veterans Affairs for guidance. The Texas Veterans Commission can advise on state benefits.

City Services: San Antonio offers rebates for energy-efficient upgrades through CPS Energy and even free trees through City programs.

Emergency Contacts: I provide all my clients a "little black book" of trusted contractors – electricians, plumbers, HVAC techs, handymen. When your first minor emergency hits, you'll know who to call.

By engaging with local resources, you're not just buying a house – you're becoming part of a community and gaining a support network.

16-20. Bonus Tips for Success

16. Avoid Common Mistakes: Don't overextend your budget. Don't skip due diligence. Don't make major financial changes during the buying process. Don't let emotions override logic.

17. Understand Property Taxes: Texas has no state income tax but higher property taxes. File for your Homestead Exemption immediately after closing – it saves you hundreds annually.

18. Plan for Maintenance: Budget 1% of your home's value yearly for maintenance. Some years you won't use it, other years you'll need a new appliance or AC repair.

19. Stay Flexible: The process rarely goes perfectly. Be prepared to adapt. Keep communication open with your agent and lender.

20. Celebrate Your Achievement: Buying your first home is a huge accomplishment! Take pride in this milestone. You're building equity and investing in your future.

Frequently Asked Questions

What is the first-time home buyer grant in San Antonio?

The primary program is the Homeownership Incentive Program (HIP). Depending on income, you can get $1,000-$30,000 in down payment assistance as a 0% interest second loan, fully forgivable if you live in the home for 5-10 years.

Who is eligible for first-time homebuyer programs in Texas?

Generally, you must not have owned a home in the past 3 years, meet income limits (varies by county), and complete a homebuyer education course. Credit score typically needs to be 620+.

What credit score is needed?

Minimum Credit Score by Loan Type

Higher scores = Better rates

- FHA: 580+

- Conventional: 620+

- VA: 600-620+ (lender dependent)

- USDA: 640+

The higher your score, the better your rates and terms.

What is the Biden grant for first-time buyers?

This refers to a proposed $25,000 federal assistance program. As of late 2025, it has NOT been passed into law. Don't count on it – focus on existing programs.

What disqualifies you as a first-time buyer?

Owning a home in the last 3 years, having income above program limits, not meeting credit requirements, or intending to use the home as an investment rather than your primary residence.

What is the best program for first-time buyers?

It depends on your situation:

- Veterans: VA loan (0% down, no PMI)

- Good credit: Conventional 3% down

- Moderate credit: FHA 3.5% down

- Rural areas: USDA 0% down

- Need down payment help: HIP or state assistance programs

Ready to Start Your Journey?

Buying your first home in San Antonio in 2026 doesn't have to be overwhelming. With the right preparation, team, and knowledge, you can navigate the process with confidence.

As a U.S. Air Force veteran and experienced Realtor®, I'm here to guide you every step of the way – from getting pre-approved to handing you the keys on closing day.

San Antonio is an incredible place to own a home. With its affordability, strong military presence, vibrant culture, and friendly communities, it's the perfect city for first-time buyers to put down roots.

Ready to kickstart your journey? Use my San Antonio Custom Home Match to get hand-picked listings, or schedule a free consultation and let's strategize your home purchase today!

Welcome home to San Antonio! 🏡

Ready to Buy Your First Home in San Antonio? Whether you're a military family, first-time homebuyer, or relocating for work, I'm here to make your 2026 move stress-free. Get personalized guidance, expert tips, and exclusive listings tailored to your needs. Call me directly at (210) 997-0763 or visit sharprealtygrouptx.com for your free consultation. Let’s turn your dream of owning a home in San Antonio into a reality!

Categories

Recent Posts