VA Assumable Loans: How They Work for San Antonio Buyers & Sellers in 2025

I’m Anthony Sharp, USAF veteran and San Antonio Realtor. If you’re home buying around JBSA and need advice, a VA assumable loan can be a smart move. You can take over the original interest rate and remaining principal balance from the seller’s VA mortgage, which can be a big win when today’s higher interest rates are near 6.5% on average. Buying or selling, I got your back.

Want me to run an Assumption Game Plan for your address or target home? Book a quick strategy call and I’ll map your options.

What is a VA loan assumption?

A VA assumption lets a qualified buyer take over the seller’s existing VA mortgage loan with the same interest rate, remaining term, and mortgage payments. You essentially step into the seller’s existing loan terms. The Department of Veterans Affairs allows assumptions if the loan is current and the buyer is creditworthy per VA standards. A key benefit is that VA loans have no private mortgage insurance (PMI), which helps the monthly payment.

For buyers: how the money part works

Rate and term: You inherit the seller’s rate and remaining long term. If the seller has a variable interest rate ARM, you inherit those terms too, so we will model future adjustments before you commit.

Equity gap: You must cover the seller’s equity as a lump sum. This can be cash, a gift, or allowed secondary financing like a home equity loan or HELOC in junior position. If you plan to borrow money to bridge the equity, we will confirm the structure meets VA rules. VA allows junior liens at assumption when they are subordinate, documented, and no cash back goes to the buyer at closing.

Funding fee: VA charges an assumption funding fee of 0.5% of the loan balance. It must be paid in cash at closing and cannot be financed into the assumed loan.

Other closing costs: Expect the holder’s assumption processing fee (often $250 to $300), plus title, recording, and credit report fees. Some areas allow an additional assumption-related fee through a locality variance.

DTI and residual income: Underwriting looks at debt-to-income ratio and residual income. VA puts strong weight on residual income, so higher DTIs can still work when residuals are solid.

Pro tip: I’ll line up the numbers side by side so you can compare purchase price, sales price, closing costs, and total cash to close across assumption vs new financing. If your primary goal is home improvement or a cash out refinance, we will evaluate whether assuming the loan supports that plan or if a different structure is better.

For sellers: your entitlement, release of liability, and timing

In your selling journey, if the buyer is VA-eligible and assumes full liability, you can request a release of liability and a substitution of entitlement, which can restore your VA entitlement for your next purchase. If the buyer is not a Veteran or does not substitute entitlement, your entitlement stays tied to the assumed loan until it is paid off. Servicers also use the VA Form 26-10291 Assumption Entitlement Acknowledgement early in the process so you know where your entitlement stands.

How fast is this? Holders with automatic authority aim to issue decisions in about 45 days once the file is complete. If VA needs to review, the appeal window is about 10 business days. I set expectations with both sides, keep documents moving, and stay on the phone with the servicer so we hit those marks.

Why this matters in San Antonio right now

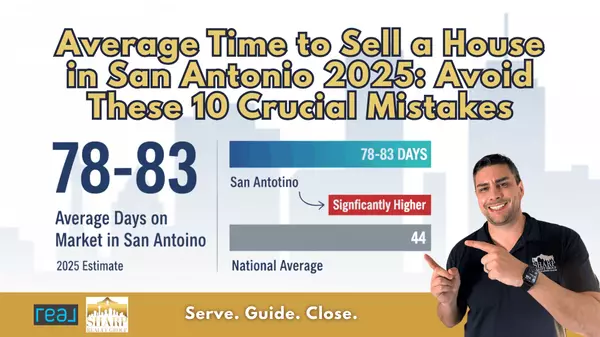

Our market shifted in 2025. Sales are slower, days on market are longer, and inventory is higher. Pricing has held near a $330,000 median in recent reports. In this climate, marketing a low-rate VA assumable can pull qualified traffic and shorten DOM in military-heavy areas around JBSA (see recent San Antonio housing coverage from local outlets like the Express-News: example market update).

Assumption vs New VA vs Conventional

| Feature | VA Assumption | New VA Purchase | Conventional |

|---|---|---|---|

| Interest rate | Seller’s existing rate | Market rate (for example, ~6.5%) | Market rate |

| PMI / MIP | No PMI | No PMI | PMI if under 20% down |

| VA or other fees | 0.5% assumption funding fee (cash) + holder fees | Standard VA funding fee per schedule | Standard lender fees + PMI if applicable |

| Appraisal | Often not required by VA; holder may set conditions | Yes, typical | Yes, typical |

| Equity needed | Cover seller’s equity (cash, gift, or allowed junior lien) | Down payment optional with full entitlement | Down payment usually required |

References linked above: VA benefits for no PMI, VA Handbook/Circulars for 0.5% fee and mechanics, PMMS for market rate context.

Curious how an assumption changes payment vs rent? Run the numbers with my Affordability Calculator, then grab a quick Home Valuation to see if your equity makes an assumption feasible.

FAQs

Can a non-Veteran assume a VA loan?

Yes, if they are creditworthy and the loan is current. Unless a VA-eligible buyer substitutes entitlement, the seller’s entitlement remains tied to the loan until payoff.

Do I need a COE as the buyer?

If you are assuming as a VA-eligible buyer and want to substitute entitlement, you will use a Certificate of Eligibility (COE) in the assumption package. The servicer follows the VA checklist in the Lenders Handbook.

How long does a VA assumption take?

Holders with automatic authority target about 45 days once the file is complete. If VA review is needed, VA aims for roughly 10 business days on appeals.

Can I use a HELOC or second lien to cover the seller’s equity?

Yes, if it is junior to the VA loan, properly subordinated, and no cash back goes to the buyer at closing. The lender must document the terms.

What if the seller’s loan is an ARM?

You assume the variable interest rate terms and future adjustments. I will model best- and worst-case payment paths so you can decide with confidence.

What is the exact assumption fee?

VA’s funding fee is 0.5% of the loan balance, due in cash at closing. The holder may also charge a processing fee and, in some areas, an Assumption Locality Variance fee.

How do I restore my entitlement after I sell?

If the buyer is a Veteran and substitutes their entitlement, you can get restoration. If not, your entitlement stays tied up until the assumed loan is paid off.

Ready to move?

If you’re PCSing to JBSA and want to purchase a home by assuming a low rate, or you’re selling and want to market your assumable the right way, I’ll lead the process, coordinate the servicer, and keep your timeline tight. Check out my PCS Advantage and read recent client testimonials.

Optional resource: Prefer video? Watch my brief overview: Expert Guide to VA Assumable Loans.

Categories

Recent Posts

Leave a Reply