Buying a House in the Military: 2025 Guide for Service Members

Quick-look (FY 2025):

• 0 % down VA loans[1]

• First-time funding-fee 2.15 %[1]

• JBSA E-5 + dependents BAH $1,935/mo[2]

Why This Guide Matters

Relocations, deployments, and an alphabet-soup of acronyms can make buying feel overwhelming. I’m a former USAF medic who’s walked 50 + VA buyers from flight line to front porch. Use this playbook to shortcut months of Googling.

1 · Confirm Your VA Loan Eligibility

| Down Payment | First Use | Subsequent Use |

|---|---|---|

| 0 % | 2.15 % | 3.30 % |

| 5 – 9.99 % | 1.50 % | 1.50 % |

| 10 + % | 1.25 % | 1.25 % |

Funding-fee waived if you receive VA disability pay.

Mini-Win: Sgt. Davis bought a $340K Cibolo home with $4K cash-to-close by rolling this fee into the loan.

Everything You Need to Know About VA Loans

Explore the Deep Dive

Explore the Deep Dive

2 · Build a PCS-Proof Budget

- Start with BAH — E-5 at JBSA = $1,935/mo[2].

- Add spouse income, subtract debt, cap housing at ≈ 35 % of gross pay.

- Run the 60-second PCS Mortgage Calculator:

Run the PCS Mortgage Calculator

Launch Calculator

Launch Calculator

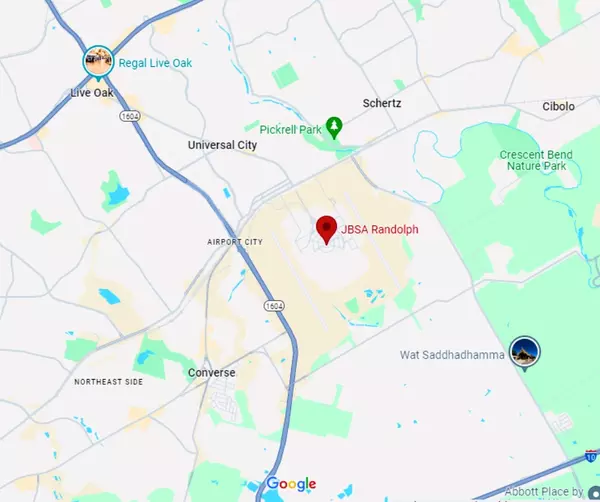

3 · Pick the Right Location

| Factor | Quick data | Source |

|---|---|---|

| Commute | Schertz 15 min · Cibolo 18 min → Randolph | Google Maps |

| Resale speed | Median DOM 56 days (Mar 2025) | SABOR |

| Rentability | Avg. rent $1,885/mo · 86 active SFH rentals | Zillow/MLS |

| Schools | Aim for GreatSchools rating ≥ 7 | greatschools.org |

Get a Free Home Valuation Report

Check My Home Value

Check My Home Value

4 · Work with a Military-Savvy Agent

- “How many VA-backed deals have you closed this year?”

- “What’s your plan if the appraisal comes in low?”

- “Can you negotiate seller-paid closing costs?”

2024 scorecard: 97 % list-to-sale on VA offers · 0 cancelled contracts.

5 · Search & Tour — Even from Overseas

- Live-stream walk-throughs (tape-measure call-outs)

- Drone street passes for realistic curb appeal

- Instant MLS alerts flagging VA-eligible homes

Book a virtual tour

Book Now

Book Now

6 · Craft a Winning Offer

| Lever | Why it helps |

|---|---|

| 1 – 2 % earnest money | Shows commitment without over-risking cash |

| 5-day inspection window | Gives sellers confidence you’ll move fast |

| Firm appraisal deadline | Keeps lender on schedule |

Offer Strategy That Wins

Learn More

Learn More

7 · Close & Prep for PCS

| Task | Typical timeline |

|---|---|

| Inspection | Day 0 – 2 |

| Upload loan docs | Day 1 – 5 |

| VA appraisal | Day 5 – 15 |

| Clear-to-close | Day 18 – 25 |

| Sign & fund | Day 30 – 35 |

Deploying? A limited power of attorney lets your spouse (or me) sign for you.

8 · Grow Long-Term Wealth

- +49 % 5-yr appreciation in the SA–New Braunfels metro

- Mortgage interest & property taxes remain deductible

- Median rent ($1,885) covers most PITI on a $350K home at 3.8 % assumed rate

Meet Your Author

I’m Anthony Sharp, and I’ve helped over 50 VA families close on homes in San Antonio. Let’s make your PCS move smooth and successful.

Schedule a call

Let’s Talk

Let’s Talk

Citations

Categories

Recent Posts

How This Veteran Celebrates July 4th in San Antonio

How to Prep Your Home for a Fast Military Sale in San Antonio

Sell My House Fast San Antonio: Your 2025 Step-by-Step Guide

How to Sell Your Home Before PCS Orders Take Effect (San Antonio Edition)

Rent vs Own in San Antonio: Guide for First-Time Buyers & Military Families

Top 5 Things I wish I knew before PCSing to Randolph

Buying a House in the Military: 2025 Guide for Service Members

Step‑by‑Step VA Loan Guide for Military PCS Homebuyers

Real Estate Market Trends in San Antonio, Texas That You NEED to Watch in 2025

PCS Guide to Randolph AFB: Neighborhoods, Schools & Local Tips