Navigating Mortgage Options in San Antonio, Texas: A Comprehensive Guide

Purchasing a home is a significant milestone in one's life, and it often involves securing a mortgage. In San Antonio, Texas, where the real estate market is dynamic and diverse, understanding your mortgage options is crucial. Whether you're a first-time homebuyer or a seasoned homeowner, this guide will provide you with valuable advice on mortgage options in San Antonio.

1. Know Your Financial Standing

Before diving into the world of mortgages, assess your financial situation. Consider factors like your credit score, income stability, and outstanding debts. Lenders in San Antonio will evaluate your financial health when determining your eligibility and interest rates. A higher credit score can result in more favorable terms, so it's essential to clean up your credit history if needed.

2. Explore Mortgage Types

San Antonio offers various mortgage types to suit different financial needs. Some common options include:

a. Conventional Loans: These loans typically require a good credit score and a down payment, with competitive interest rates. They're suitable for those with strong financial profiles.

b. FHA Loans: Backed by the Federal Housing Administration, these loans require lower down payments and more flexible credit requirements, making them accessible for first-time buyers.

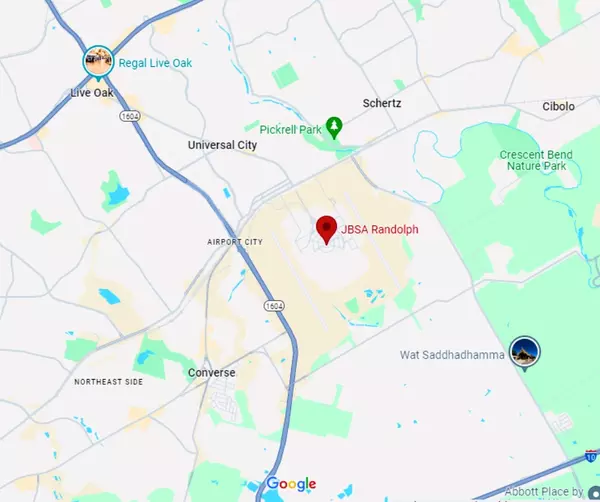

c. VA Loans: If you're a veteran or active-duty service member, VA loans offer zero-down financing options with competitive terms.

d. USDA Loans: Ideal for rural and suburban areas around San Antonio, USDA loans require no down payment and offer low-interest rates for eligible applicants.

e. Jumbo Loans: These are for high-value properties exceeding conventional loan limits. Be prepared for stricter requirements and larger down payments.

3. Consider Down Payment Options

The amount you can put down upfront significantly impacts your mortgage terms. While the standard down payment is 20% of the home's purchase price, many San Antonio homebuyers opt for lower percentages. However, lower down payments may lead to private mortgage insurance (PMI) costs. Explore local down payment assistance programs and grants to help reduce the initial financial burden.

4. Shop Around for Lenders

San Antonio boasts a competitive mortgage market with numerous lenders vying for your business. Don't settle for the first offer you receive. Shop around and compare interest rates, fees, and loan terms. You can consult local banks, credit unions, and online lenders to find the best deal that aligns with your financial goals.

5. Understand Closing Costs

In addition to the down payment, homebuyers in San Antonio should budget for closing costs. These fees cover various expenses like loan origination, appraisal, title search, and escrow services. Understanding these costs upfront can prevent financial surprises later in the home-buying process.

6. Get Preapproved

A preapproval letter from a lender not only helps you determine your budget but also strengthens your position as a serious buyer when making offers on homes. It can give you an edge in San Antonio's competitive real estate market.

7. Consult with Local Real Estate Experts

Navigating the San Antonio real estate market can be challenging, but local real estate agents and mortgage brokers can provide valuable insights and assistance. They can recommend reputable lenders, guide you through the process, and help you find properties that match your criteria.

Conclusion

Securing a mortgage in San Antonio, Texas, involves careful consideration of your financial situation, understanding the available mortgage options, and working with the right professionals. By following these tips and doing your due diligence, you can make informed decisions and achieve your homeownership dreams in this vibrant Texan city. Remember that each individual's financial situation is unique, so it's crucial to tailor your mortgage choice to your specific needs and goals.

Categories

Recent Posts