Understanding Home Financing in Cibolo, TX: A Comprehensive Guide for Home Buyers

Starting Your Home Buying Journey in Cibolo, TX

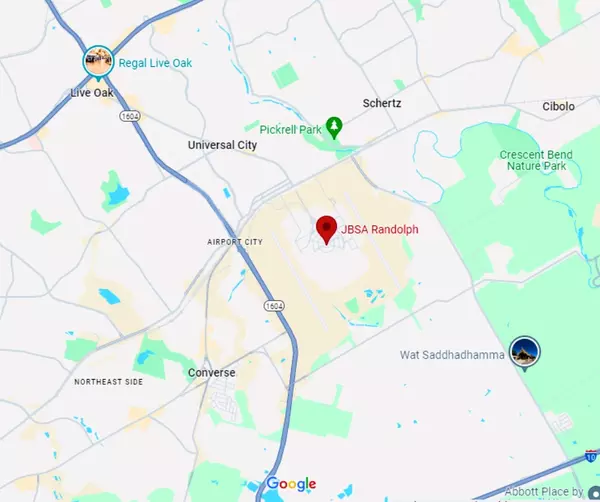

Hey there, future homeowners! Today, we're taking a deep dive into the housing market in the fast-growing city of Cibolo, Texas. Known for its vibrant community, exceptional schools, and bustling economy, Cibolo has quickly become one of the most sought-after locations for home buyers in Lone Star State.

According to Zillow, as of the time of writing, the median home value in Cibolo is on the rise, reflecting the city's growing popularity. But while the idea of buying a home in this dynamic city can be exciting, it's equally crucial to understand the intricacies of financing this significant investment.

Why Home Financing Knowledge Is Power

Remember the saying, "Knowledge is power?" It's particularly true in the world of home buying. Getting to grips with the home financing process can seem like a daunting task, especially for first-time buyers. However, understanding the basics can save you not only time but also money, and let's be real—who doesn't love saving money?

A comprehensive understanding of home financing can empower you to make informed decisions and negotiate better terms. It can help you determine how much home you can afford, what types of loans are available, and what financial assistance programs you may qualify for. Ultimately, the more you know, the more confident you'll feel when it's time to sign on the dotted line.

What's Coming Up: An Overview of the Article

So, what exactly are we going to cover in this article? Great question! We've structured this guide to give you a clear understanding of home financing in Cibolo, TX. We'll start with the basics of home financing, including what it is and the different types of mortgages you'll come across. We'll also explain the role your credit score plays in securing a mortgage.

Next, we'll explore the local lending institutions in Cibolo. We'll review the banks and credit unions you can consider and the benefits of using a local lender. Then, we'll guide you through the mortgage application process.

We'll also dive into the financing programs and assistance available for home buyers in Cibolo. We'll provide an overview of the federal and state programs out there for first-time buyers and veterans, and break down any Cibolo-specific incentives you should know about.

Lastly, we'll share some handy tips and advice on home financing. From getting pre-approved to improving your credit score and saving for a down payment, we'll cover it all. Plus, we'll discuss the importance of working with a knowledgeable real estate agent who knows the ins and outs of the Cibolo market.

Alright, buckle up, folks! It's time to embark on your home financing journey in Cibolo, TX. Let's get started!

Home Financing 101

We're kicking things off with the fundamentals of home financing. When we say "home financing," we're talking about the process of obtaining a loan (also known as a mortgage) to purchase a property. Typically, you'll pay back this loan over an agreed period, with a certain amount of interest.

Now, not all mortgages are created equal. There are different types of mortgages available, each with its unique features and advantages. The most common ones you'll come across are conventional loans, Federal Housing Administration (FHA) loans, and Veteran's Affairs (VA) loans.

-

Conventional loans are mortgages not insured by the federal government. They often require a higher credit score and a larger down payment, but they're flexible and can be used for all types of properties.

-

FHA loans are insured by the federal government. They're great for first-time home buyers as they have lower credit score requirements and allow for a smaller down payment.

-

VA loans are for veterans and active military members. These loans often require no down payment and offer competitive interest rates. You can learn more about these loan types on the Consumer Financial Protection Bureau website.

Your credit score plays a significant role in the financing process. It's used by lenders to assess your creditworthiness and determine the interest rate they'll offer you. Experian, one of the top three credit bureaus in the U.S., provides excellent resources on understanding your credit score and how to improve it.

Local Lenders: The Charm of Cibolo, TX

There's no place like home, and when it comes to securing a mortgage, there's nothing like working with a local lender. Local lenders, such as Broadway Bank and Randolph-Brooks Federal Credit Union, have an intimate knowledge of the Cibolo market and can offer personalized services to meet your needs.

Local lenders can guide you through the application process, explaining each step so you can navigate it with ease. From gathering the necessary documentation to preparing for underwriting, they're there to assist you.

In our next section, we'll delve into the financing programs and assistance available in Cibolo. Stay tuned!

Unraveling the Financing Programs & Assistance

Buying a home is a significant financial commitment, but you don't have to do it alone. There are several financing programs and assistance options available to help make homeownership more accessible and affordable.

At the federal level, the FHA, VA, and the United States Department of Agriculture (USDA) all provide loan programs for specific groups, including first-time home buyers, military personnel, and those living in rural areas. You can explore these options on the U.S. Department of Housing and Urban Development's website.

In addition to federal programs, Texas also offers assistance for home buyers. The Texas Department of Housing and Community Affairs (TDHCA) provides several programs, including low-interest loan options and down payment assistance.

For Cibolo residents, there's the Guadalupe County First-Time Home Buyer Program, which provides down payment and closing cost assistance to eligible residents.

Practical Tips & Advice: Navigating the Financing Maze

Now that we've covered the basics let's get into some practical tips and advice to help you navigate your home financing journey.

-

Get Pre-Approved: Before you start house hunting, get pre-approved for a mortgage. It will give you a clear idea of how much you can afford and show sellers that you're serious about buying.

-

Save for a Down Payment: The larger your down payment, the smaller your loan and monthly payments will be. Start saving as early as possible. Websites like NerdWallet provide excellent strategies for saving for a down payment.

-

Work with a Local Real Estate Agent: A knowledgeable local real estate agent can guide you through the buying process, connect you with local lenders, and help you find the right home in Cibolo, TX.

There you have it, your comprehensive guide to home financing in Cibolo, TX. Remember, buying a home is a significant financial decision. Take your time, do your research, and don't hesitate to seek professional advice. Happy house hunting!

Financial Wisdom: Keep Your Budget in Check

In the excitement of purchasing a home, it's easy to stretch your budget to its limit. However, doing so could leave you "house poor" - owning a beautiful home, but having no money left for other necessities or leisure. To avoid this situation, it's crucial to set a realistic budget and stick to it.

Keep in mind, the total cost of homeownership isn't just the mortgage payment. It includes property taxes, homeowners insurance, maintenance, utilities, and possibly homeowners association (HOA) fees. You can use online calculators like this one from Zillow to get an estimate of these costs.

Hiring Professionals: Getting the Right Help

Enlisting the help of professionals can be a game-changer in your home-buying journey. A reputable real estate agent with local knowledge can guide you through the process, negotiate the best price for you, and address any issues that may arise. Similarly, a mortgage broker can help you understand your financing options and guide you toward the best mortgage product for your circumstances.

Remember to take the time to research and choose professionals you trust. Websites like Realtor.com and Zillow offer reviews and ratings of real estate agents, and the Better Business Bureau can provide information about mortgage brokers.

Conclusion: Your Dream Home in Cibolo, TX Awaits

Understanding home financing can seem intimidating, but it doesn't have to be. With the right knowledge and resources, you can navigate the financing process with confidence and secure your dream home in Cibolo, TX. We hope this guide has shed light on what you need to know about financing and has brought you one step closer to owning a home in the beautiful city of Cibolo.

Whether you're a first-time home buyer or a seasoned property investor, Cibolo, TX, is a city full of promise and potential. So, what are you waiting for? Your dream home awaits!

As always, if you have any questions or need further guidance, don't hesitate to reach out. Happy home hunting!

Categories

Recent Posts