FHA Loan Market Share Surges to 14% in Q2 2023: A Positive Shift for Homebuyers

In Q2 2023, the market share of FHA loans witnessed a significant rise, reaching an impressive 14%. This surge signals a positive trend in the housing market, providing greater accessibility and opportunities for homebuyers.

Key Factors Driving the Surge

1. Affordability and Flexibility: Lower down payment requirements make FHA loans an attractive option for buyers facing financial constraints.

2. Inclusive Lending: Lenient credit score criteria open doors to homeownership for those with less-than-perfect credit histories.

3. First-Time Buyer Appeal: As demand for homeownership increases, FHA loans become an appealing choice for first-time buyers.

Impact on the Housing Market

1. Increased Buyer Activity: Sellers may see a rise in offers as more qualified buyers enter the market.

2. Market Stability: The surge contributes to a more balanced and stable housing market.

3. Possible Inventory Challenges: Heightened demand could exacerbate existing inventory shortages.

Considerations for Homebuyers

1. Mortgage Insurance Premium (MIP): Factor in MIP costs when evaluating affordability.

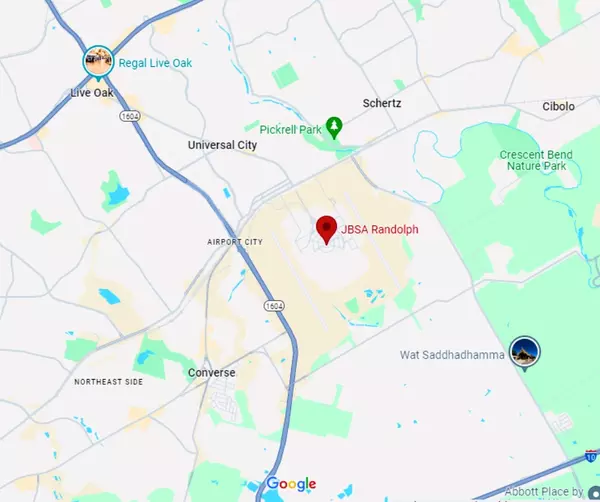

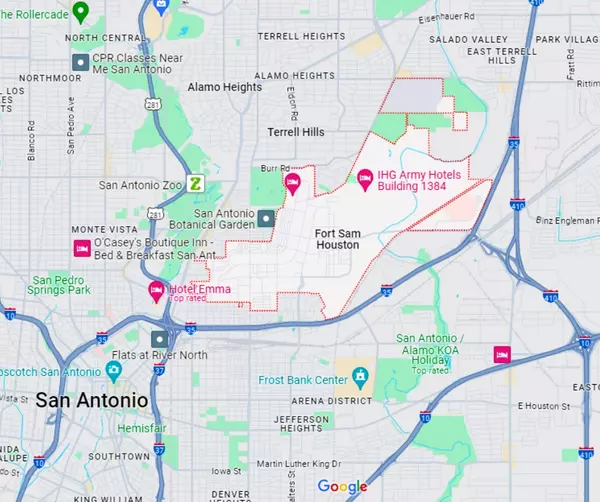

2. Loan Limits: Be aware of FHA loan limits based on property location.

3. Long-Term Planning: Consider refinancing options as financial situations evolve.

The surge in FHA loan market share in Q2 2023 bodes well for homebuyers seeking better access to the housing market. Understanding its implications empowers buyers and sellers to navigate the evolving real estate landscape confidently.

Categories

Recent Posts